41 coupon rate calculator for bonds

All the 21 Types of Bonds | General Features and Valuation | eFM 13/06/2022 · Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor. › finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

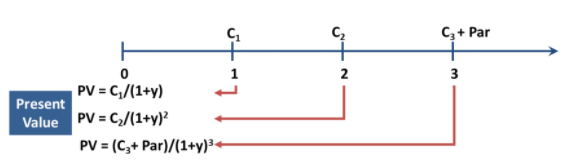

Bond Yield Calculator - CalculateStuff.com In order to calculate YTM, we need the bond's current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below: Where: Bond Price = current price of the bond. Face Value = amount paid to the bondholder at maturity. Coupon = periodic coupon payment.

Coupon rate calculator for bonds

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond. Interest is compounded semi-annually throughout the duration, or at the end of each fraction of a half-year for any fractional years ... Bond Calculator | Calculates Price or Yield - Financial Calculators Calculate either a bond's price or its yield-to-maturity plus over a dozen other attributes with this full-featured bond calculator. If you are considering investing in a bond, and the quoted price is $93.50, enter a "0" for yield-to-maturity. Also, enter the settlement date, maturity date, and coupon rate to calculate an accurate yield. Bond Price Calculator c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity. After the bond price is determined the tool also checks how the bond should sell in comparison to the other similar bonds on the market by these rules:

Coupon rate calculator for bonds. SEBI Investor | Bond Calculator Advertisement for empanelment of Securities Market Trainers (SMARTs) Booklet on Securities Market: Securities Market - Understanding from Investors' Perspective. asksebi@sebi.gov.in. Call Us: 1800227575 / 18002667575. . Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Where: Price+1%: Bond price when yield increases by 1% Price-1%: Bond price when yield decreases by 1% Price: Current trading price Δyield: Percentage point change in yield (note that it's squared; sign doesn't matter) But – stick with the better convexity formula if you have time to calculate it (or come back and visit this page!). Bond Yield Calculator The algorithm behind this bond yield calculator takes account of these variables: Bond's current clean price is the market selling price today; Bond's coupon rate (interest rate). Annual interest payment = Bond's face value * Bond's coupon rate (interest rate) * 0.01. Please remember that the coupon rate is in decimal format thus it ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

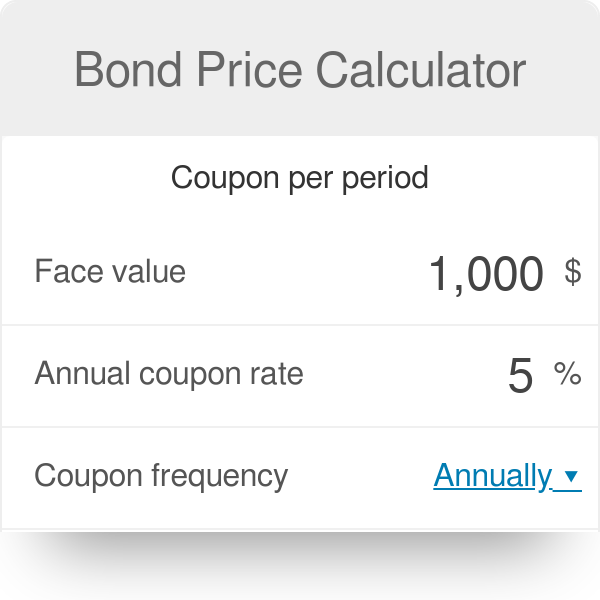

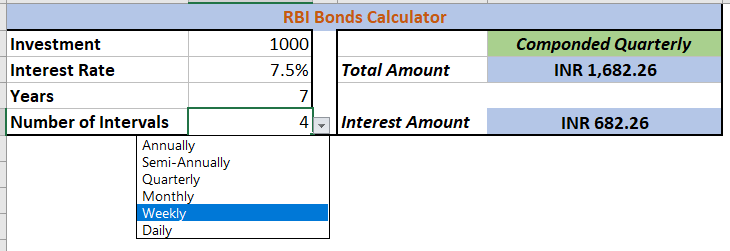

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond. Interest is compounded semi-annually throughout the duration, or at the end of each fraction of a half-year for any fractional years ... Compound Interest Calculator - Moneychimp Compound interest - meaning that the interest you earn each year is added to your principal, so that the balance doesn't merely grow, it grows at an increasing rate - is one of the most useful concepts in finance. It is the basis of everything from a personal savings plan to the long term growth of the stock market. Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =. Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

What Is a Coupon Rate? How To Calculate Them & What They're Used For Coupon rates can be determined by dividing the sum of the annual coupon payments by the actual bond's face value. However, this is not the same as the interest rate. For instance, a bond with a face value of $5,000 and a coupon of 10%, pays $500 every year. However, if you buy a bond above its face value, let's say at $7,000, you will get a ... Financial Calculators Bond Calculator Instruction. The Bond Calculator can be used to calculate Bond Price and to determine the Yield-to-Maturity and Yield-to-Call on Bonds Bond Price Field - The Price of the bond is calculated or entered in this field. Enter amount in negative value. Face Value Field - The Face Value or Principal of the bond is calculated or ... Coupon Rate Calculator | Bond Coupon 15/07/2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ... › coupon-rate-formulaCoupon Rate Formula | Calculator (Excel Template) - EDUCBA Below are the steps to calculate the Coupon Rate of a bond: Step 1: In the first step, the amount required to be raised through bonds is decided by the company, then based on the target investors (i.e. retail or institutional or both) and other parameters face value or par value is determined as a result of which, we get to know the number of bonds that will be issued.

What Is the Coupon Rate of a Bond? - The Balance The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate.

moneychimp.com › calculator › compound_interest_calculatorCompound Interest Calculator - Moneychimp Compound interest - meaning that the interest you earn each year is added to your principal, so that the balance doesn't merely grow, it grows at an increasing rate - is one of the most useful concepts in finance. It is the basis of everything from a personal savings plan to the long term growth of the stock market.

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Coupon Rate Calculator | Solution Step by Step 🥇 The coupon rate is the percentage of an issued security's face value that is paid out as interest by the issuer. The formula for calculating a bond's coupon rate is: \text {Coupon Rate} = \frac {\text {Coupon Payments}} {\text {Face Value}} The coupon rate is often expressed as a percentage, but it can also be expressed in decimal form.

› bond-calculatorBond Pricer & YTM Calculator – Calculate Bond Prices and ... This is called the coupon rate or coupon yield. Coupon Rate = Annual Interest Payment / Bond Face Value However, if the annual coupon payment is divided by the bond's current market price, the investor can calculate the current yield of the bond.

Coupon Rate: Formula and Bond Yield Calculator - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a...

› finance › Bond-PriceBond Price Calculator c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity. After the bond price is determined the tool also checks how the bond should sell in comparison to the other similar bonds on the market by these rules:

Coupon Rate Formula | Step by Step Calculation (with Examples) Do the Calculation of the coupon rate of the bond. Annual Coupon Payment Annual coupon payment = 2 * Half-yearly coupon payment = 2 * $25 = $50 Therefore, the calculation of the coupon rate of the bond is as follows - Coupon Rate of the Bond will be - Example #2 Let us take another example of bond security with unequal periodic coupon payments.

Bond Yield Calculator | Calculate Bond Returns coupon rate is the annual interest you will receive by investing in the bond, and frequency is the number of times you will receive it in a year. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest annually. Determine the years to maturity

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

Zero-Coupon Bond: Formula and Calculator - Wall Street Prep Zero-Coupon Bond Price Formula. To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods.

Bond Present Value Calculator Use the Bond Present Value Calculator to compute the present value of a bond. Input Form Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Below are the steps to calculate the Coupon Rate of a bond: Step 1: In the first step, the amount required to be raised through bonds is decided by the company, then based on the target investors (i.e. retail or institutional or both) and other parameters face value or par value is determined as a result of which, we get to know the number of bonds that will be issued.

Annualized Rate of Return Formula | Calculator - EDUCBA Let us take an example of an investor who purchased a coupon paying a $1,000 bond for $990 on January 1, 2005. The bond paid coupon at the rate of 6% per annum for the next 10 years until its maturity on December 31, 2014. Calculate the annualized rate of return earned by the investor from the bond investment.

Bond Yield Calculator is here! - IndiaBonds This is called the coupon rate or coupon yield. Coupon Rate = Annual Interest Payment / Bond Face Value However, if the annual coupon payment is divided by the bond's current market price, the investor can calculate the current yield of the bond.

Coupon Payment Calculator Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 With the coupon payment calculator, you can find the periodic coupon payment for any bond by simply inputting the number of payments per year on the bond indenture.

Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders.

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Zero coupon bonds are back in flavour. Will the party continue? 06/09/2022 · This has brought back zero coupon bonds back in flavour. The Monetary Policy Committee (MPC) has raised the repo rate by 140 basis points since May to 5.4 percent to tame inflation. One basis ...

› news › businessZero coupon bonds are back in flavour. Will the party continue? Sep 06, 2022 · This has brought back zero coupon bonds back in flavour. The Monetary Policy Committee (MPC) has raised the repo rate by 140 basis points since May to 5.4 percent to tame inflation. One basis ...

Bond Yield Calculator - Compute the Current Yield - DQYDJ On this page is a bond yield calculator to calculate the current yield of a bond. Enter the bond's trading price, face or par value, time to maturity, and coupon or stated interest rate to compute a current yield. The tool will also compute yield to maturity, but see the YTM calculator for a better explanation plus the yield to maturity formula.

How To Find Coupon Rate Of A Bond On Financial Calculator Coupon Rate = (Coupon Payment / Par Value) x 100 For example, you have a $1,000 par value bond with an annual coupon payment of $50. The bond has 10 years until maturity. Using the formula above, we would calculate the coupon rate as follows: Coupon Rate = ($50 / $1,000) x 100 = 5% Own or Dealer Bid

Bond Price Calculator c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity. After the bond price is determined the tool also checks how the bond should sell in comparison to the other similar bonds on the market by these rules:

Bond Calculator | Calculates Price or Yield - Financial Calculators Calculate either a bond's price or its yield-to-maturity plus over a dozen other attributes with this full-featured bond calculator. If you are considering investing in a bond, and the quoted price is $93.50, enter a "0" for yield-to-maturity. Also, enter the settlement date, maturity date, and coupon rate to calculate an accurate yield.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond. Interest is compounded semi-annually throughout the duration, or at the end of each fraction of a half-year for any fractional years ...

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "41 coupon rate calculator for bonds"