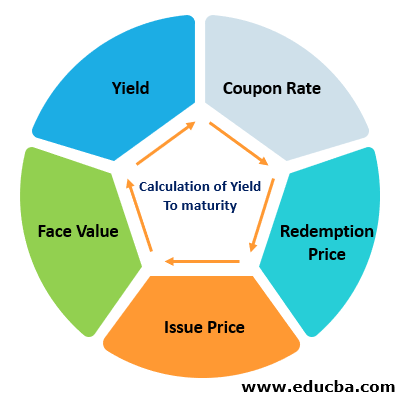

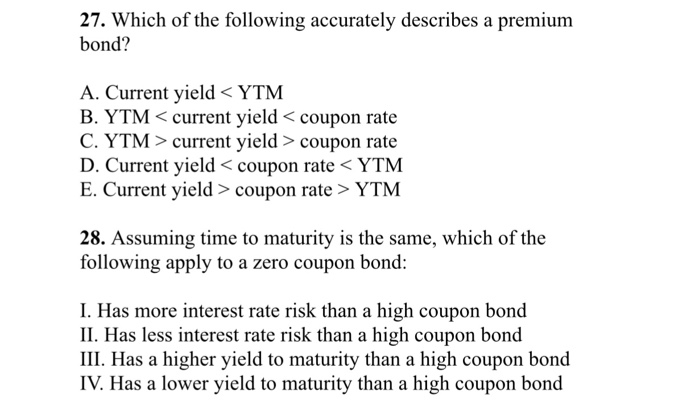

42 coupon rate and ytm

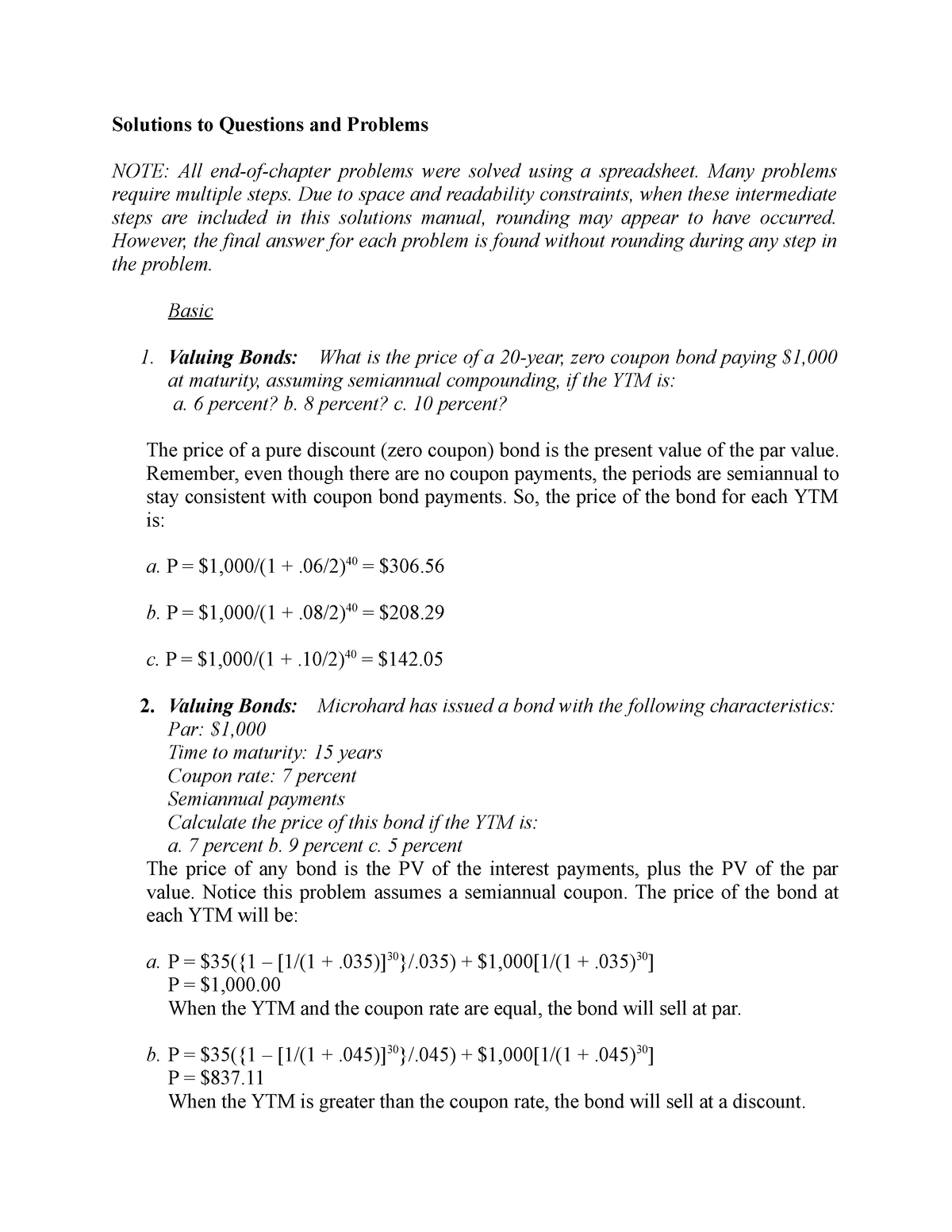

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =. Current Yield vs. Yield to Maturity: What's the Difference? A bond's yield is measured in different ways. Two common yields that investors look at are current yield and yield to maturity. Current yield is a snapshot of the bond's annual rate of return, while yield to maturity looks at the bond over its term from the date of purchase. 1.

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is $1150, then the yield on the bond will be 3.5%. Coupon vs. Yield Infographic Let's see the top differences between coupon vs. yield.

Coupon rate and ytm

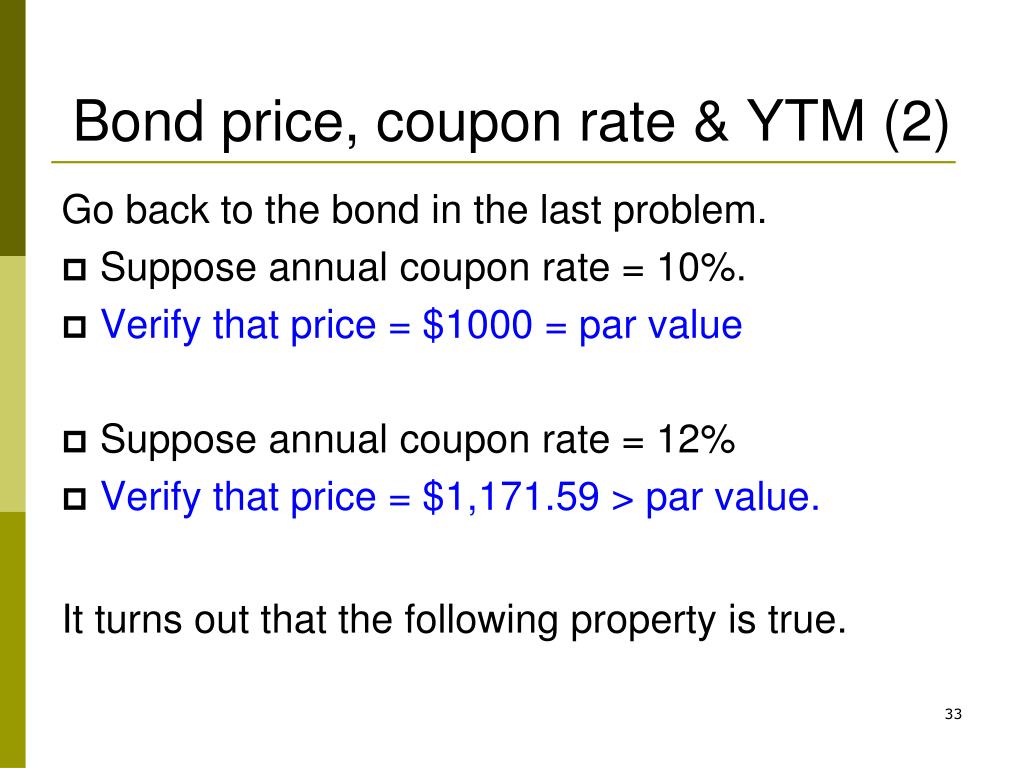

Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Coupon rate is a fixed value in relation to the face value of a bond. If yield to maturity is greater than the coupon rate, the bond is trading at a discount to its par value. › coupon-rate-formulaCoupon Rate Formula | Step by Step Calculation (with Examples) The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more will increase because an investor will be willing to purchase the bond at a higher value. A bond trades at par when the coupon rate is equal to the market interest rate. Recommended Articles. This has been a guide to what is Coupon Rate Formula. Current Yield vs. Yield to Maturity - Investopedia The YTM formula is a more complicated calculation that renders the total amount of return generated by a bond based on its par value, purchase price, duration, coupon rate, and the power of ...

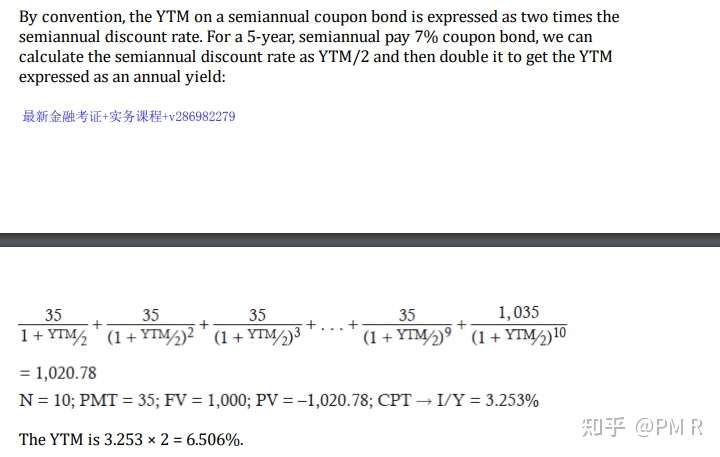

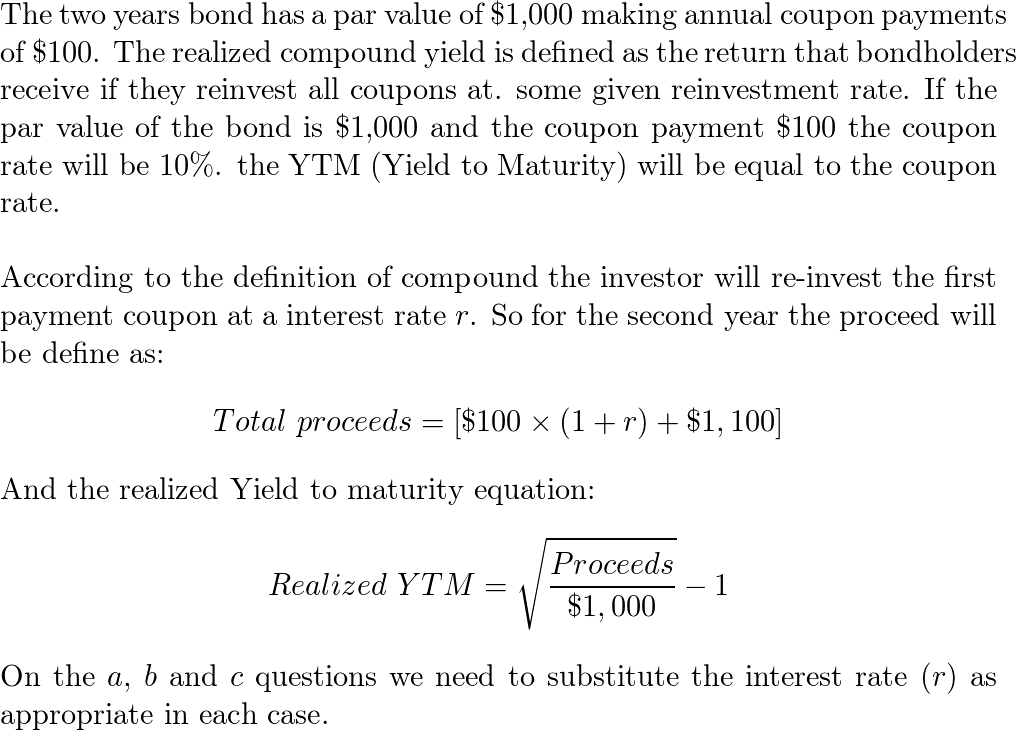

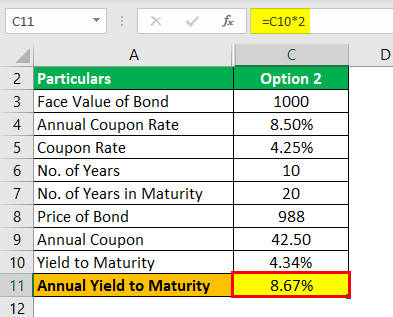

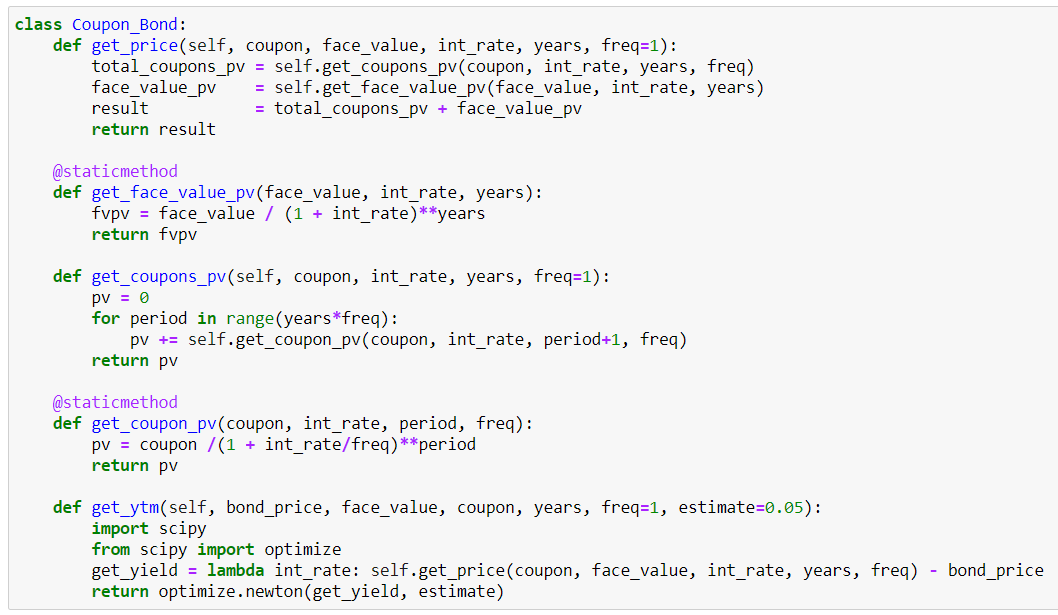

Coupon rate and ytm. financetrainingcourse.com › education › 2012How to calculate Spot Rates, Forward Rates & YTM in EXCEL Jan 31, 2012 · c. How to calculate the Yield to Maturity (YTM) of a bond. The equation below gives the value of a bond at time 0. The cash flows of the bond, coupon payments (CP) and Maturity Value (MV = Principal Amount + Coupon payment) have been discounted at the yield-to-maturity (YTM) rate, r, in order to determine the present value of cash flows or alternatively the price or value of the bond (V Bond). Yield to Maturity - YTM vs. Spot Rate: What's the Difference? Calculating the yield to maturity is a complicated process that assumes all coupon, or interest, payments can be reinvested at the same rate of return as the bond. Luckily, there are online YTM ... Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ...

Coupon Rate vs Current Yield vs Yield to Maturity (YTM) - YouTube In this lesson, we explain the coupon rate, current yield, and yield to maturity (YTM). We go through the coupon rate formula, current yield formula, and the... › terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Difference Between YTM and Coupon rates Summary: 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per year, and is expressed as a percentage of the face value of the bond. 2. YTM includes the coupon rate in its calculation. Author. Difference Between Coupon Rate and Yield to Maturity The coupon rate remains the same throughout the bond tenure year, while Yield to Maturity (YTM) changes with the period left for the bond maturation and also on the current market value of the bond. The coupon rate represents the interest payment rates that are to be received annually by the bond receiver.

Difference between YTM and Coupon Rates YTM is the acronym for "yield to maturity", and it measures the rate of return an investor would earn if they held a bond until it reached maturity. YTM accounts for both the interest payments made (the coupon rate) as well as any capital gains or losses. A coupon rate, on the other hand, is simply the interest rate that is paid out on a ... Yield to Maturity (YTM): Formula and Bond Calculator - Wall Street Prep What is the Yield to Maturity (YTM)? The Yield to Maturity (YTM) represents the expected annual rate of return earned on a bond under the assumption that the debt security is held until maturity. From the perspective of a bond investor, the yield to maturity (YTM) is the anticipated total return received if the bond is held to its maturity date and all coupon payments are made on time and are ... Yield to Maturity (YTM) - Investopedia Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Yield to Maturity (YTM) - Overview, Formula, and Importance Yield to Maturity (YTM) - otherwise referred to as redemption or book yield - is the speculative rate of return or interest rate of a fixed-rate security. ... On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like ...

› bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples where C = Periodic coupon payment, F = Face / Par value of bond, r = Yield to maturity (YTM) and; n = No. of periods till maturity; On the other, the bond valuation formula for deep discount bonds or zero-coupon bonds Zero-coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to ...

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

Yield to Maturity (YTM) - Meaning, Formula and Examples - Groww The formula of current yield: Coupon rate / Purchase price. Naturally, if the bond purchase price is equal to the face value, the current yield will be equal to the coupon rate. Current Yield = 160/2,000 = 0.08 or 8%. Let's say the purchase price falls to 1,800. Current Yield = 160/1,800= 0.089 or 8.9%. The current Yield rises if the purchase ...

Calculate the Coupon Rate of a Bond - YouTube This video explains how to calculate the coupon rate of a bond when you are given all of the other terms (price, maturity, par value, and YTM) with the bond ...

› finance › yield-to-maturityYield to Maturity Calculator | Calculate YTM Jul 14, 2022 · Calculate the YTM; The YTM can be seen as the internal rate of return of the bond investment if the investor holds it until it matures and reinvests the coupon at the same interest rate. Hence, the YTM formula involves deducing the YTM r in the equation below: bond price = Σ k=1 n [cf / (1 + r) k], where: cf - Cash flows, i.e., coupons or the ...

› finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

Current Yield vs. Yield to Maturity - Investopedia The YTM formula is a more complicated calculation that renders the total amount of return generated by a bond based on its par value, purchase price, duration, coupon rate, and the power of ...

› coupon-rate-formulaCoupon Rate Formula | Step by Step Calculation (with Examples) The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more will increase because an investor will be willing to purchase the bond at a higher value. A bond trades at par when the coupon rate is equal to the market interest rate. Recommended Articles. This has been a guide to what is Coupon Rate Formula.

Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Coupon rate is a fixed value in relation to the face value of a bond. If yield to maturity is greater than the coupon rate, the bond is trading at a discount to its par value.

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "42 coupon rate and ytm"