38 pricing zero coupon bonds

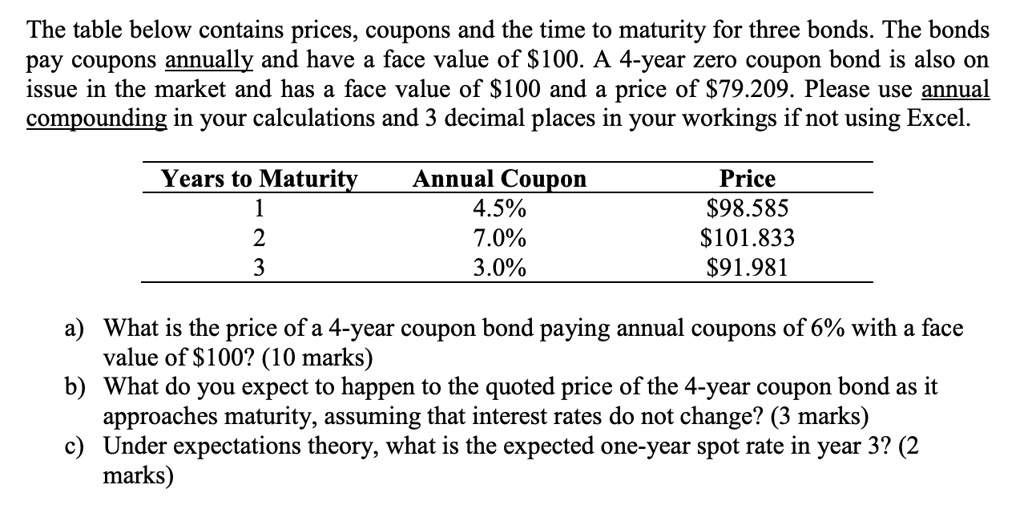

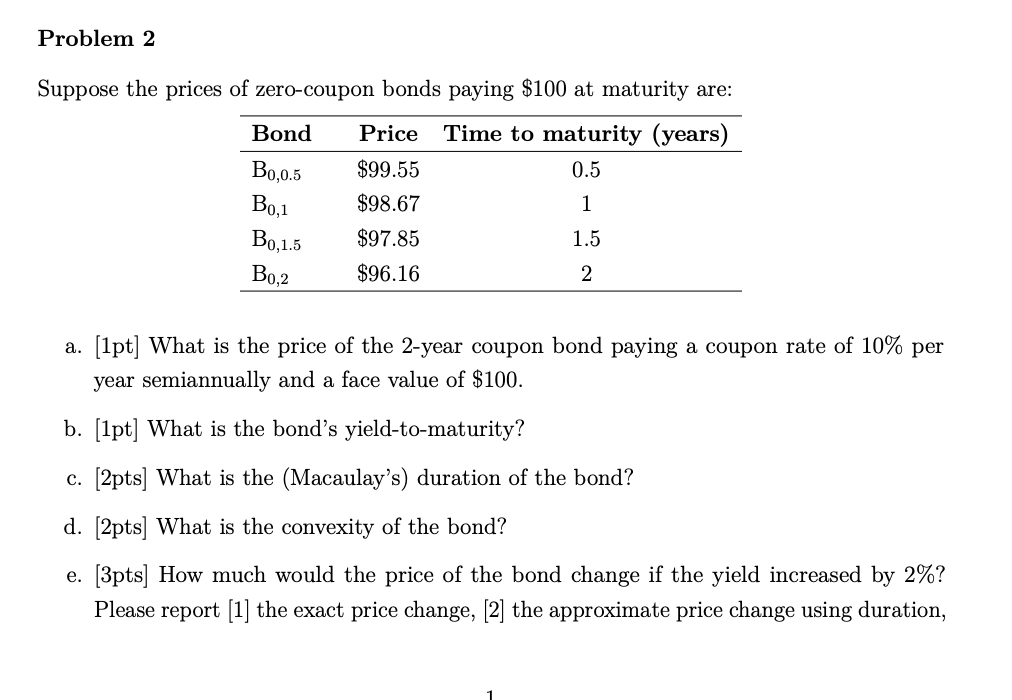

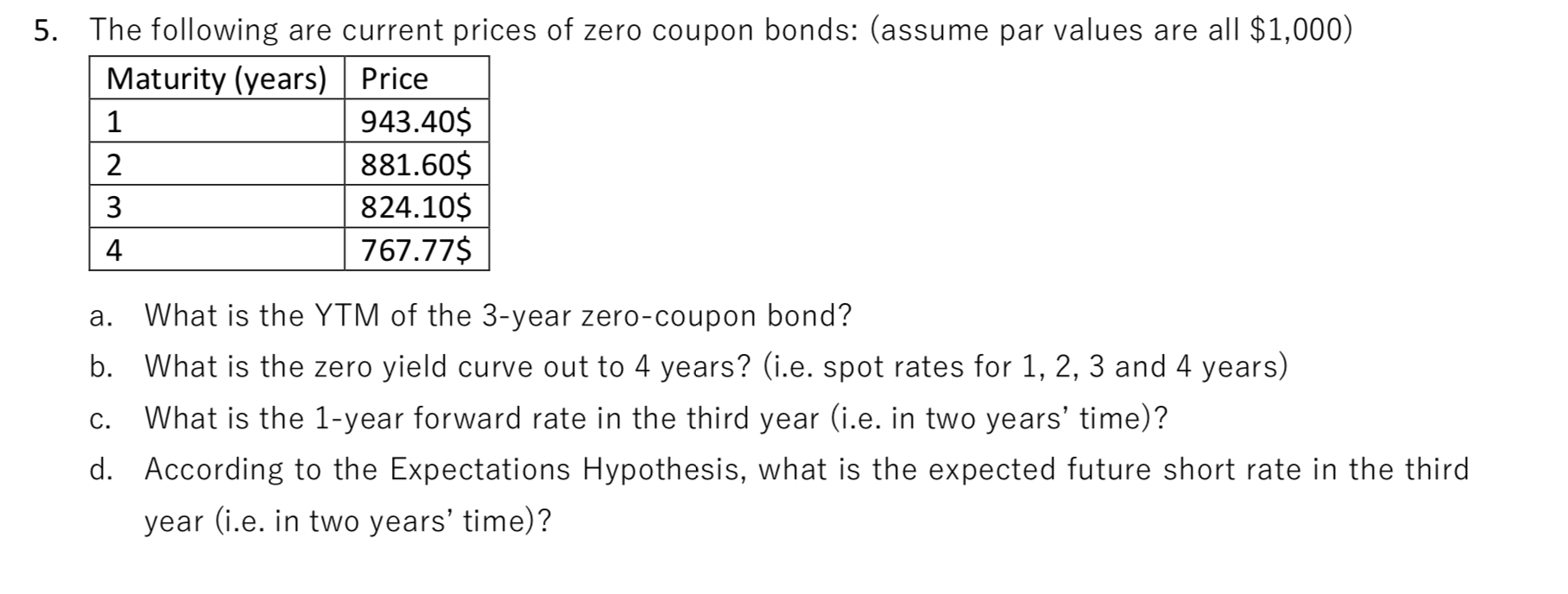

Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... Zero-Coupon Bond Definition - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

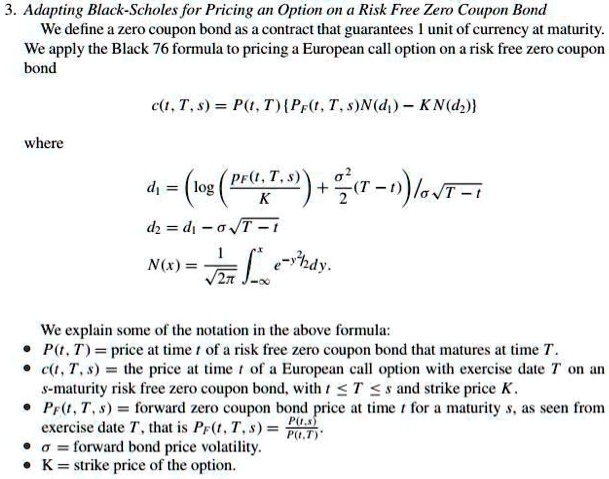

Zero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds. To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or ...

Pricing zero coupon bonds

Municipal Bonds - Fidelity Zero-coupon bonds Zero-coupon municipal bonds are issued at an original issue discount, with the full value, including accrued interest, paid at maturity. Interest income may be reportable annually, even though no annual payments are made. Market prices of zero-coupon bonds tend to be more volatile than bonds that pay interest regularly. Markets Explained | Project Invested Markets Explained. The Building Blocks of CMOs: Mortgage Loans & Mortgage Pass-Throughs What are Zero-Coupon Bonds? (Characteristics and Examples) Zero-coupon bonds are often perceived as long-term investments, although one of the most common examples is a “T-Bill,” a short-term investment. U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Learn More → Zero Coupon Bond (SEC) Zero-Coupon Bond Price Formula

Pricing zero coupon bonds. Assignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply. What are Zero-Coupon Bonds? (Characteristics and Examples) Zero-coupon bonds are often perceived as long-term investments, although one of the most common examples is a “T-Bill,” a short-term investment. U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Learn More → Zero Coupon Bond (SEC) Zero-Coupon Bond Price Formula Markets Explained | Project Invested Markets Explained. The Building Blocks of CMOs: Mortgage Loans & Mortgage Pass-Throughs Municipal Bonds - Fidelity Zero-coupon bonds Zero-coupon municipal bonds are issued at an original issue discount, with the full value, including accrued interest, paid at maturity. Interest income may be reportable annually, even though no annual payments are made. Market prices of zero-coupon bonds tend to be more volatile than bonds that pay interest regularly.

Post a Comment for "38 pricing zero coupon bonds"