42 zero coupon bond yield calculation

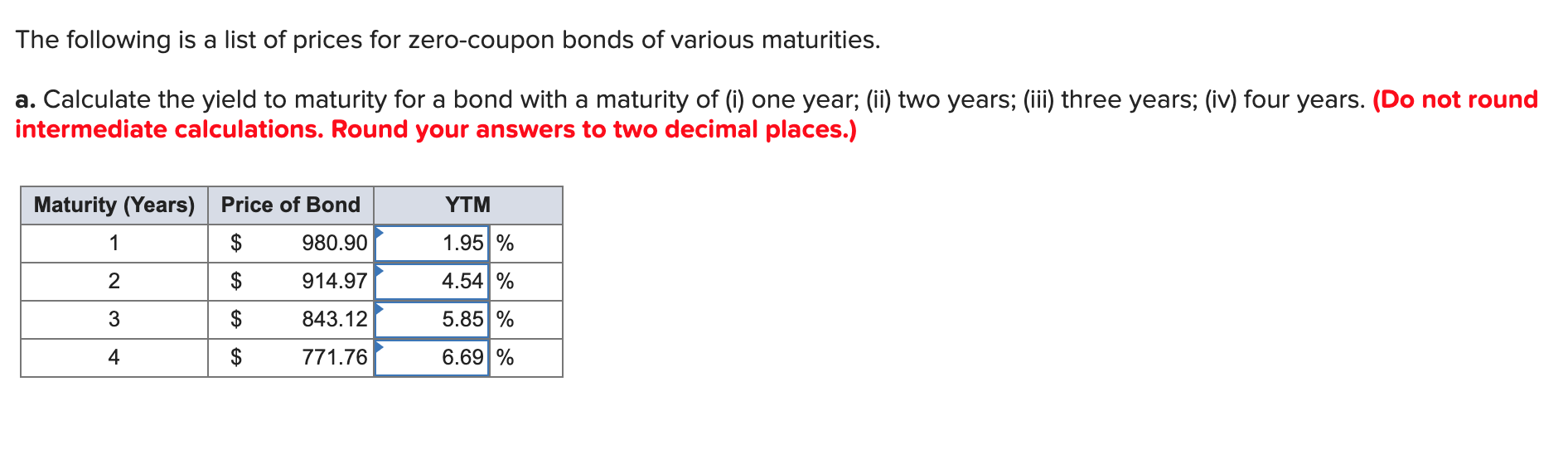

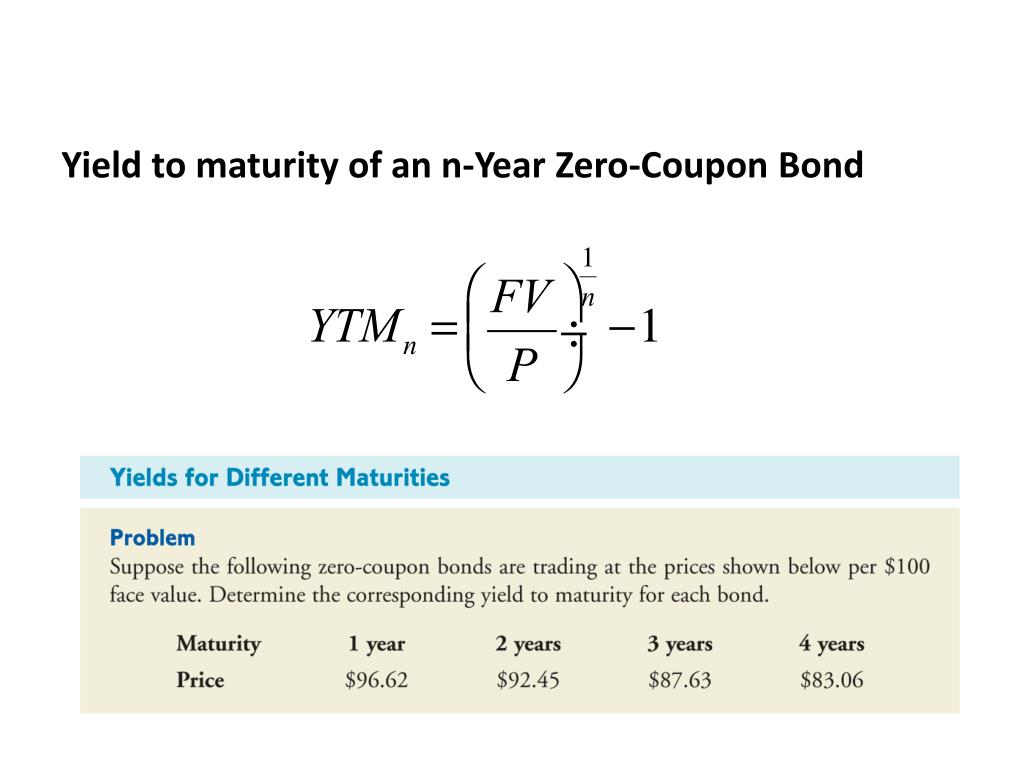

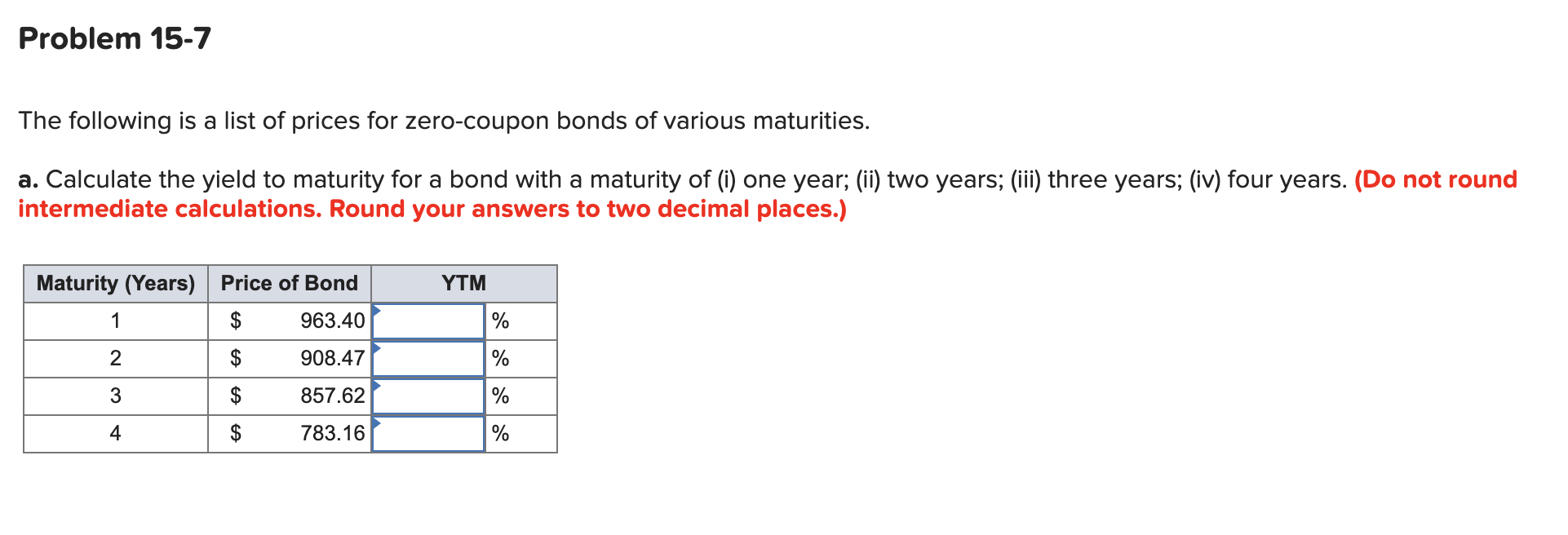

Zero Coupon Bond Yield - Financial Formulas (with Calculators) The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

Zero Coupon Bond Calculator – What is the Market Price ... P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ...

Zero coupon bond yield calculation

Zero coupon yields – explanation of the calculations 12 Apr 2021 — Treasury bills (zero coupon securities) and government bonds (coupon securities). Norges Bank calculates zero coupon yields using a ...3 pages Zero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. Bond Valuation: Calculation, Definition, Formula, and Example May 31, 2022 · Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ...

Zero coupon bond yield calculation. Zero coupon yield - ACT Wiki 1 Jul 2022 — The zero coupon yield is equal to the current market rate of return on investments in zero coupon bonds of the same maturity. Example: Cash ... What Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · A bond's yield is the discount rate that links the bond's cash flows to its current dollar price. A bond's coupon rate is the periodic distribution the holder receives. How do I Calculate Zero Coupon Bond Yield? 27 Sept 2022 — Zero coupon bond yield is calculated by using the present value equation and solving it for the discount rate. The resulting rate is the ...

How to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ... Bond Valuation: Calculation, Definition, Formula, and Example May 31, 2022 · Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ... Zero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. Zero coupon yields – explanation of the calculations 12 Apr 2021 — Treasury bills (zero coupon securities) and government bonds (coupon securities). Norges Bank calculates zero coupon yields using a ...3 pages

:max_bytes(150000):strip_icc()/GettyImages-983195940-6d4c5099c3314718a5ba16c33205d071.jpg)

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "42 zero coupon bond yield calculation"