42 step up coupon bonds

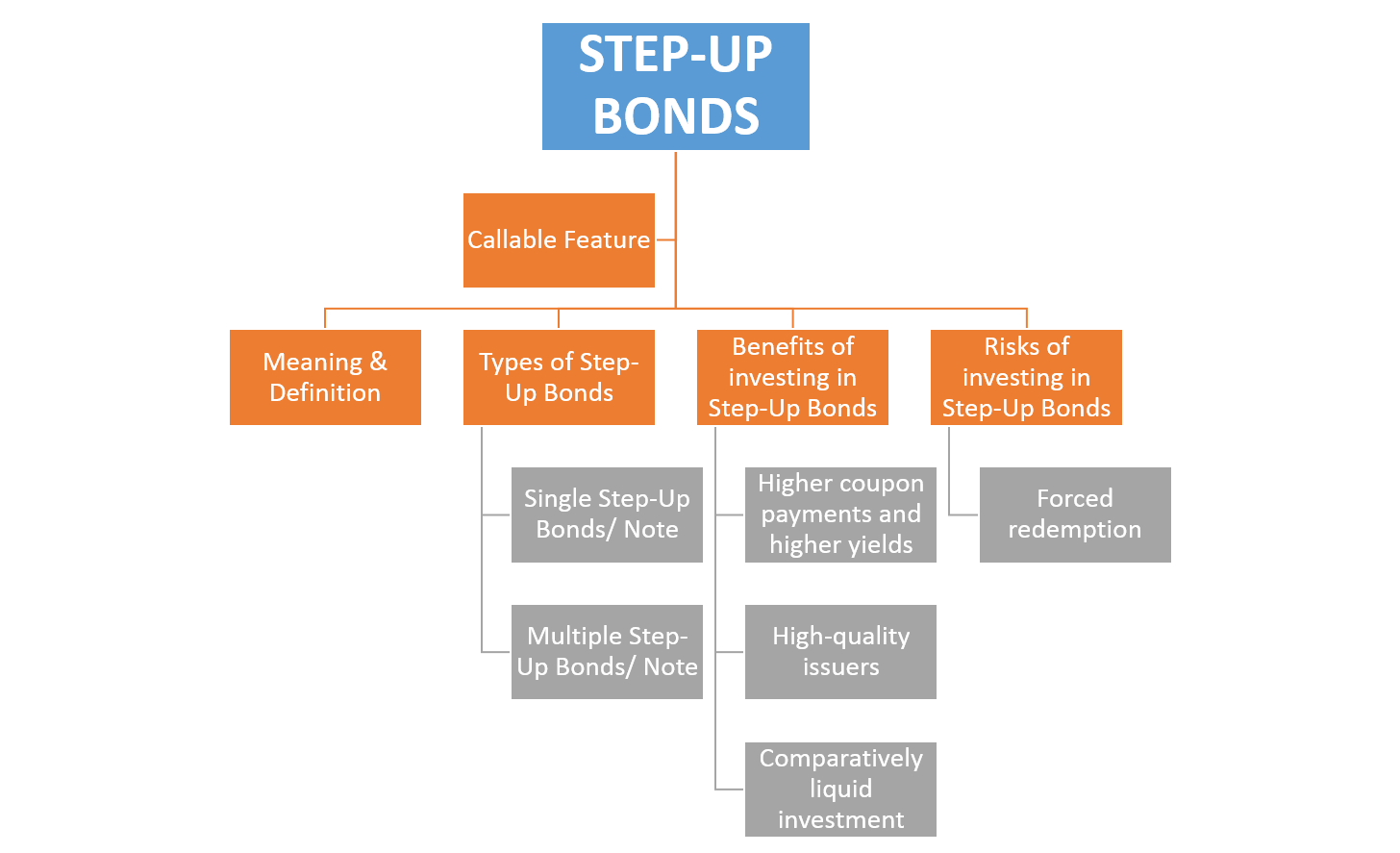

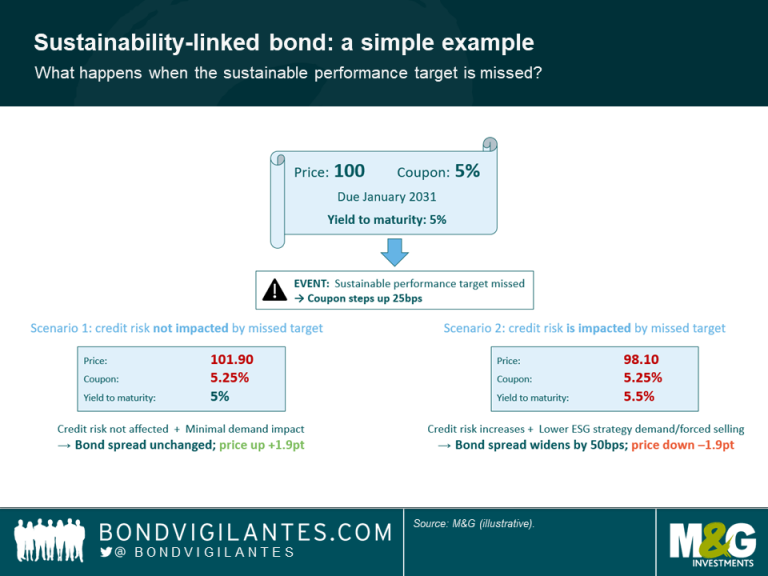

Step Up Bonds: Pros and Cons - linkedin.com Some of these advantages are mentioned below: Higher Yields: Step-up bonds are designed to provide guaranteed higher yields to investors. The bonds are created in such a way that the... Types of bonds based on cash flows - Fixed Income - AlphaBetaPrep A step-up coupon bond is a bond, either fixed or variable, whose spread increases incrementally over the life of the bond. Bonds with step-up coupons offer protection against rising market interest rates. It is because when market interest rates increase, the bond's coupon rates also increase thereby limiting any decrease in bond value.

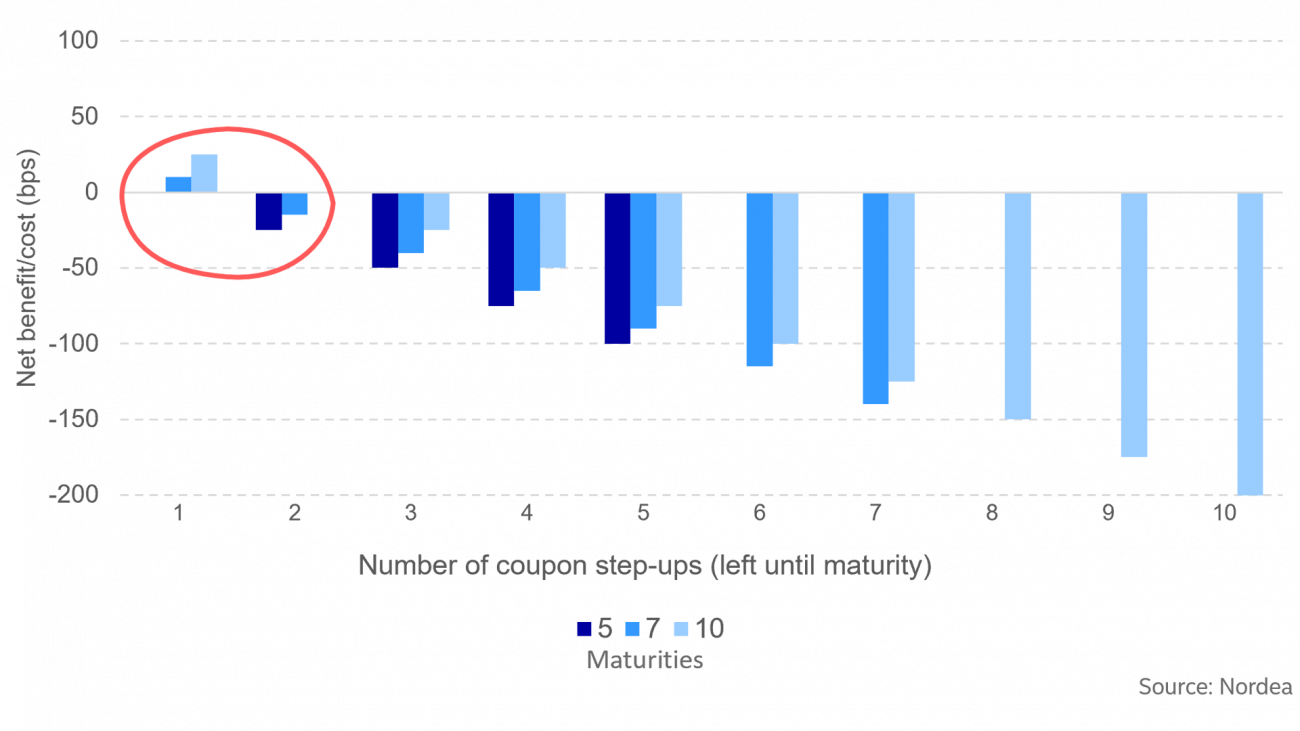

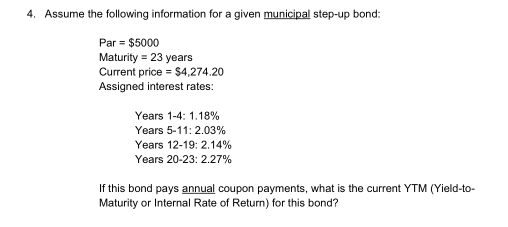

PDF An Analysis of Step-Up Fixed Income Securities The step-ups may not be better than a fixed income bond. If what drew you to the step-up was those big yield numbers, think again. Considerations What are some of the considerations in purchasing these step-up ... Step-Up CD Date- Coupon Rate Actual Yield to Date Actual Yield to Date 01/20/2017 - 2.000% 2018 - 2% 2018 - 1% ...

Step up coupon bonds

Step Up Bonds: Pros and Cons - Management Study Guide Higher Yields: Step-up bonds are designed to provide guaranteed higher yields to investors. The bonds are created in such a way that the coupon payments in the last few years of the existence of the bonds are much larger than the expected interest rate during the same period. Coupon Step-up Definition | Law Insider Define Coupon Step-up. On the Distribution Date following the first possible optional termination date, the margin on the Certificates will increase to the following, subject to the applicable Net WAC Pass-Through Rate. Class After Optional Termination ----- ----- A Certificates 2 x Margin Mezzanine Certificates 1.5 x Margin ----- The depositor has filed a registration statement (including a ... Step-Up Bonds Definition & Example | InvestingAnswers What are Step-Up Bonds? A step-up bond is a bond with a coupon that increases ('steps up'), usually at regular intervals, while the bond is outstanding. Step-up bonds are often issued by government agencies. How Do Step-Up Bonds Work? Let's consider a five-year step-up bond issued by Company XYZ.

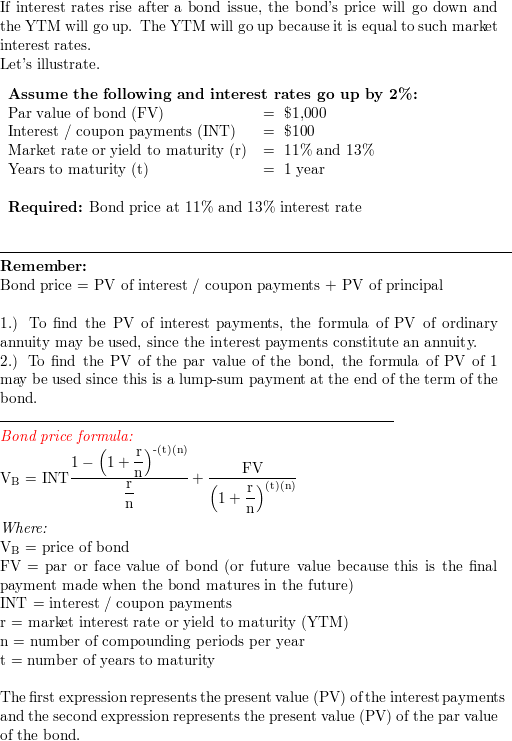

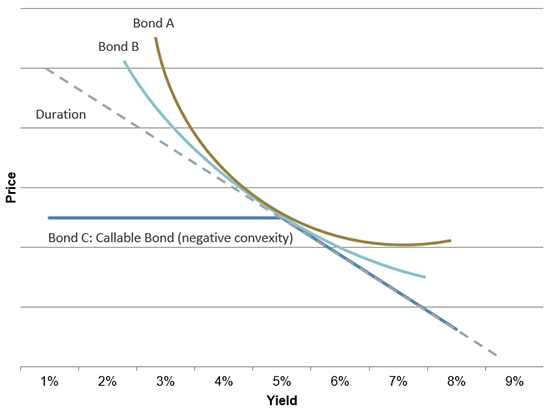

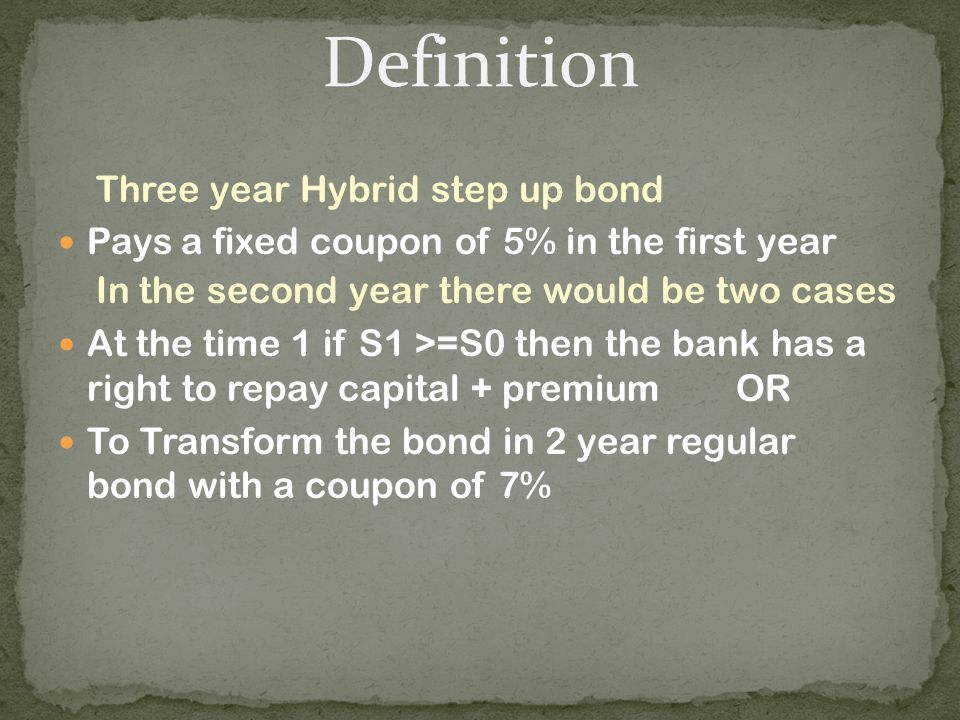

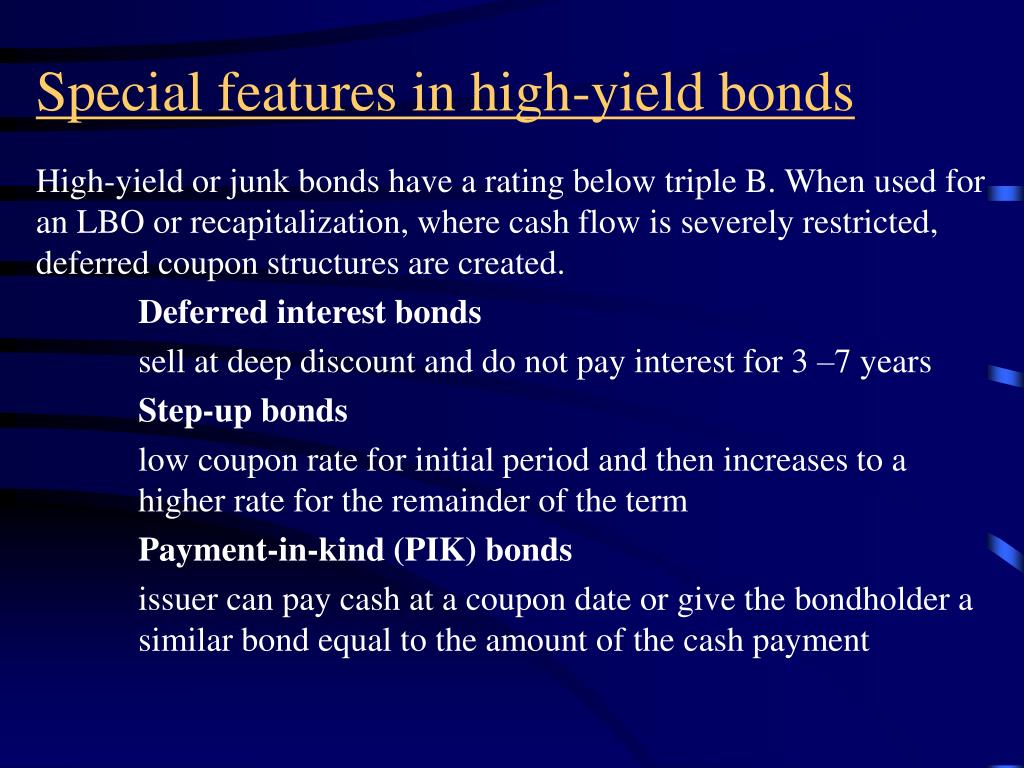

Step up coupon bonds. Stepped coupon bond financial definition of stepped coupon bond A bond with interest coupons that change to predetermined levels on specific dates. Thus, a stepped coupon bond might pay 9% interest for the first 5 years after issue and then step up the interest every fifth year until maturity. Issuers often have the right to call the bond at par on the date the interest rate is scheduled to change. Step-Up Bond Definition - Investopedia Because the coupon payment increases over the life of the bond, a step-up bond lets investors take advantage of the stability of bond interest payments while benefiting from increases... Are step-up bonds good protection against rising rates? These are bonds where the coupon usually steps up after a certain period. They may also be designed to step up not once but in a series too. These are also called as a dual coupon or multiple coupon bonds. These are just the opposite of Step-Up Bonds. These are bonds where the coupon usually steps down after a certain period. Step-Up & Step-Down Bond - Cbonds.com Step-Up and Step-Down bonds are fixed-rate bonds characterized by a trend, determined at the issue of the bond itself, which may be respectively increasing or decreasing over time. The typical predetermined coupon structure or variable over time represents this peculiar characteristic common to both types of bonds. Example of a bond.

What are Step-up Bonds? Example, Types, Advantages, and ... - CFAJournal The coupon rate of the bond increases to 5% in its final year. It means the lender will receive $30 for each of the first two years, $45 for year two and year three, and finally receive $50 in the last year. The lender will also receive $1,000 on the maturity of the bond, as usual. Types of Step-Up Bonds Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years. Step-Coupon Bond - Fincyclopedia In this sense, a step-coupon bond is similar in structure to a deferred-interest bond ( DIB) except that it is initially issued with a low coupon interest, which is later readjusted upward. A step-coupon bond may have an embedded call option which the issuer can exercise as the coupon level rises. This bond is also known as a reset bond. S 864 Deferred Coupon Bonds | Definition, How it works? Types, Advantages These deferred interest bonds pay interest on maturity at a single coupon rate. Assume a bond with an annual yield of 5%, and its coupons deferred till maturity. At maturity, the investor will be paid the principal of the bond. Along with this, 5% interest for the total deferred period is also paid. Step-up Bonds

Step Up Bonds: Pros and Cons - nclexmadeeasy.org Step-up bonds are special types of fixed income instruments. ... As a result, the extra coupon which may be gained by selling the bond and reinvesting the proceeds may be lost upfront as the value of the bond goes down in value. As a result, investors do not have any incentive to trade such bonds. They are generally held to maturity. For an ... What Do I Need to Know About Step-Up Bonds? | Finance - Zacks One-step bonds have their coupon payment stepped up once during the life of the bond. For example, the coupon payment on a five-year bond may be 5 percent in the first and second... Accounting for Step-Up Bond | Example | Advantage - Accountinguide Multi Step-up bond is the step-up bond in which the coupon rate increases more than one before the maturity date. Advantage of Step Up Bond. High return for investors: Investors will receive more return by investing in step-up bonds, the interest rate will keep increasing over time. If compared to normal bonds, the step-up bonds will generate ... Finance | Step-Up Bond Typically, issuers embed step-up coupon bonds with call options which give them the right to redeem the bonds at par on the date the coupon is set to step up. This bond is also known as a dual-coupon bond, a rising-coupon bond, or a stepped-coupon bond. Read more Comments Last update:Mar 17, 2019

Why Step-Up Bonds? | Meaning, Reason, Types, Benefit, etc | eFM Step-up bonds or notes are a type of bond with a coupon rate that increases over time. These securities are called step-up bonds because the coupon rate "steps up" over time. For example, the step-up bond could have a 5% coupon rate for the first two years, 5.5% for the third and fourth years, and 6% for the fifth year.

What is a Step-Up Bond? - Accounting Hub Step-up bonds are a special type of bond that comes with rising interest rates. These bonds offer a low-interest rate initially and then an increased interest rate after a specific period. It can come with a single interest rate rise or multiple interest rate increases. The interest rates can also be linked with inflation rates.

What Is a Step-up Bond? - The Balance But suppose you had a step-up bond that offered 0.5% annual coupon increases. The step-up feature gives you some protection against rising interest rates. After year one, you could earn 3.5%. After year two, you'd receive 4%, and so on. However, there's no guarantee that step-ups will keep up with market rates. How Step-up Bonds Work

Coupon Bond: Definition, How They Work, Example, and Use Today The coupon rate is calculated by taking the sum of all the coupons paid per year and dividing it with the bond's face value. Real-World Example of a Coupon Bond If an investor purchases a...

Step-Up Bond Definition - PFhub Step-Up Bond. Bonds in which the coupon rates 'step-up' during later period of the bond tenure. Random Finance Terms for the Letter S. Statement of Financial Accounting Standards No. 8. Statement of Financial Accounting Standards No. 52. Static Theory of Capital Structure. Statutory Surplus.

Coupon Bond - Guide, Examples, How Coupon Bonds Work Nevertheless, the term "coupon" is still used, but it merely refers to the bond's nominal yield. How Does a Coupon Bond Work? Upon the issuance of the bond, a coupon rate on the bond's face value is specified. The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These ...

Step Coupon Bonds Definition | Law Insider Examples of Step Coupon Bonds in a sentence. The 2015 Series A Serial Bonds and Term Bonds are subject to optional redemption prior to maturity on or after July 1, 2025, and the 2015 Series A Step Coupon Bonds are subject to optional redemption prior to maturity on or after July 1, 2020 at a price of 100%.

Step-Up CDs: What They Are And How They Work | Bankrate For example, a step-up CD might start with a 0.3 percent interest rate and increase by 0.1 percent annual percentage yield (APY) every six months for two years. The rates over time would be: First ...

Step-Up Coupon Bond - Harbourfront Technologies What is a Step-Up Coupon Bond? A step-up coupon bond, or step-up bond, is a debt instrument that pays comes with a lower initial interest rate. However, it includes a feature that provides increasing rates after specific periods. There is no standard for step-up bonds to follow when it comes to interest rate increases.

Step-Ups - Types of Fixed Income Bonds | Raymond James Introduction to Step-up Bonds: At the most basic level, step-up bonds have coupon payments that increase ("step-up") over the life of the bond according to a predetermined schedule. In most cases, step-ups become callable by the issuer on each anniversary date that the coupon resets or continuously after an initial non-call period.

Step-Up Bonds Definition & Example | InvestingAnswers What are Step-Up Bonds? A step-up bond is a bond with a coupon that increases ('steps up'), usually at regular intervals, while the bond is outstanding. Step-up bonds are often issued by government agencies. How Do Step-Up Bonds Work? Let's consider a five-year step-up bond issued by Company XYZ.

Coupon Step-up Definition | Law Insider Define Coupon Step-up. On the Distribution Date following the first possible optional termination date, the margin on the Certificates will increase to the following, subject to the applicable Net WAC Pass-Through Rate. Class After Optional Termination ----- ----- A Certificates 2 x Margin Mezzanine Certificates 1.5 x Margin ----- The depositor has filed a registration statement (including a ...

Step Up Bonds: Pros and Cons - Management Study Guide Higher Yields: Step-up bonds are designed to provide guaranteed higher yields to investors. The bonds are created in such a way that the coupon payments in the last few years of the existence of the bonds are much larger than the expected interest rate during the same period.

:max_bytes(150000):strip_icc()/investment-3999136_1920-7e692563c3ea473d968c27d90ba7c5c6.jpg)

Post a Comment for "42 step up coupon bonds"