43 payment coupon for irs

› publications › p537Publication 537 (2021), Installment Sales - IRS tax forms You sell property for $100,000. The sales agreement calls for a down payment of $10,000 and payment of $15,000 in each of the next 6 years to be made from an irrevocable escrow account containing the balance of the purchase price plus interest. PDF 2021 Form 770-PMT, Payment Coupon - Virginia Tax Form 770-PMT 2021 Payment Coupon (DOC ID 511) *No Staples Please* To Be Used For Payments On Previously Filed 2021 Fiduciary or Unified Nonresident Income Tax Returns Effective for payments made on and after July 1, 2021, Pass-Through entities must submit all unified nonresident

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow 1. Use the coupon rate and the face value to calculate the annual payment. If you know the face value of the bond and its coupon rate, you can calculate the annual coupon payment by multiplying the coupon rate times the bond's face value. For example, if the coupon rate is 8% and the bond's face value is $1,000, then the annual coupon payment ...

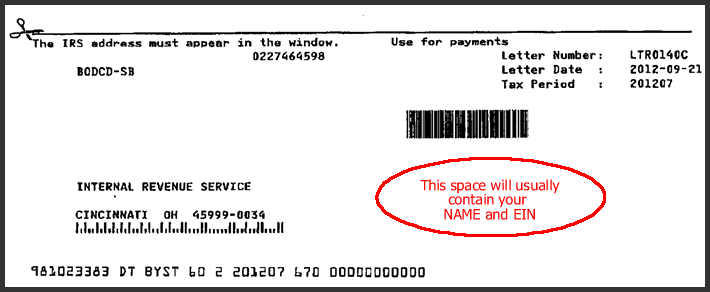

Payment coupon for irs

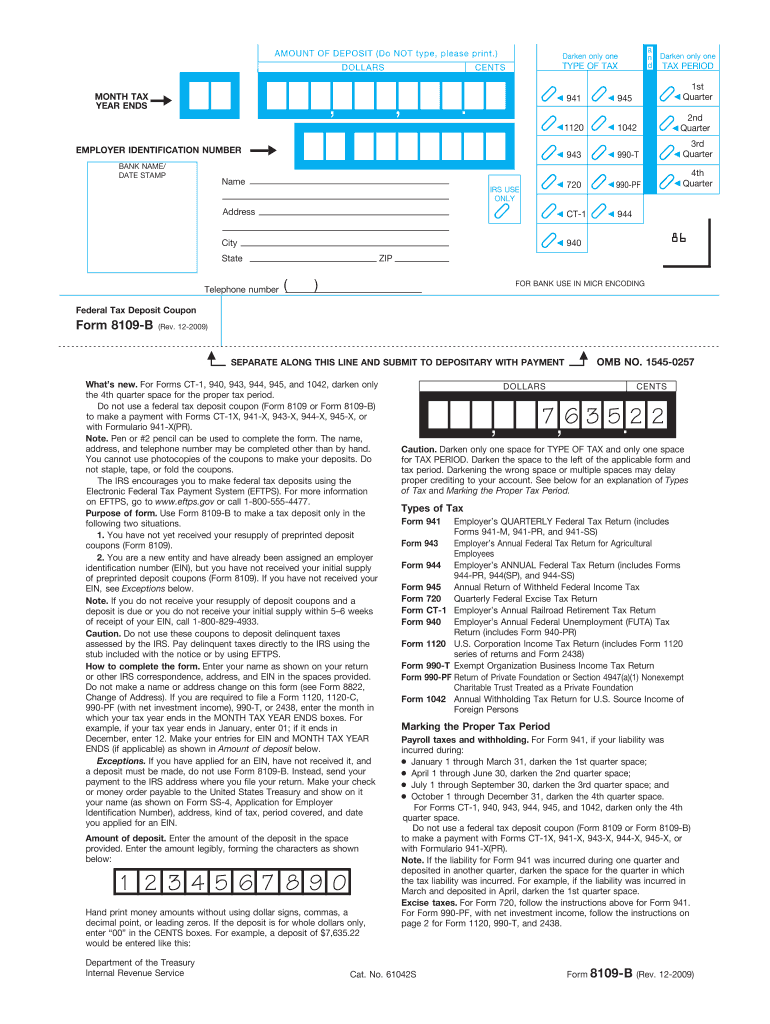

2022 IL-501 Payment Coupon - Withholding (Payroll) Tax Forms - Illinois 2022 IL-501 Payment Coupon - Withholding (Payroll) Tax Forms Revenue Forms Withholding (Payroll) Tax Forms 2022 IL-501 Payment Coupon Did you know you can make this payment online? Paying online is quick and easy! Click here to pay your IL-501 online Click here to download the PDF payment coupon Form 941-V Payment Voucher - Taxbandits You can only use payment voucher Form 941-V if your total taxes for the current or previous quarter are less than $2,500, you didn't incur a $100,000 next-day deposit obligations during the current tax quarter, and you're paying the amount you owe in full by the deadline. Payment Coupon Templates - 11+ Free Printable PDF Documents Download Payment Coupon Templates - 11+ Free Printable PDF Documents Download. A payment coupon template was designed to help you help customers make payments at the counter in a personalized way. The coupon template is only used at an instance where you want your customers to purchase available items at discount prices.

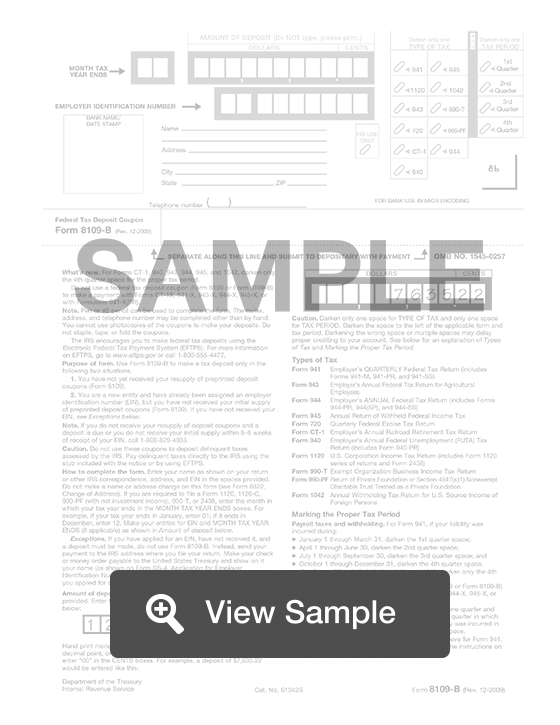

Payment coupon for irs. PDF 2021 Form 1040-V - IRS tax forms . Cat. No. 20975C Form . 1040-V (2021) Detach Here and Mail With Your Payment and Return Form. 1040-V. Department of the Treasury Internal Revenue Service (99) Payment Voucher. . Do not staple or attach this voucher to your payment or return. . Go to . . for payment options and information. OMB No. 1545-0074. 2021. Print or type. 1 Generating estimated tax vouchers for an 1120 Corporation - Intuit Per the IRS Form 1120-W instructions, ... and corporate income tax). This includes installments payments of estimated tax. Forms 8109 and 8109-B, Federal Tax Coupon, can no longer be used to make federal tax deposits. Generally, electronic funds transfers are made using the Electronic Federal Tax Payment System (EFTPS). ... Irs 1040 Es 2021 Payment Voucher Coupon Irs 1040 Es 2021 Payment Voucher Coupon All TimePast 24 HoursPast WeekPast month Listing: 16Coupon Codes Cash Back Free Shipping Share Your Coupon Codes 2021 FORM 1040-ES - IRS TAX FORMS 54 years ago Payment Coupon Books, Payment Books - Bank-A-Count.com Payment coupon books are the easy way to collect payment from your customers. Books have a variety of features and can be customized to suit your individual needs. Choose from custom inserts, coupon formats, and more! All Bank-A-Count products are backed by an outstanding customer service team. Payment books feature: Affordable, competitive pricing

IRS Payment Plan Calculator: Finding your Minimum IRS payment How to calculate the minimum monthly payment (individuals only) based on IRS thresholds. $10,000, $25,000, and $50,000 or less owed. For the sake of brevity, and general lack of difference, the above thresholds are grouped together for this blog, particularly because the focus is on finding the minimum monthly payment. IRS Payment - IRS Office Near Me There are several ways to make an IRS payment. 1 Make an IRS payment online 2 Make an IRS payment with a check or money order 3 Where to mail IRS payments Make an IRS payment online You can pay with your bank account for free or use a credit card or debit card (processing fee charged). Option 1: Make a payment using your bank account Coupon Definition - Investopedia Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. › irb › 2004-33_IRBInternal Revenue Bulletin: 2004-33 - IRS tax forms Aug 16, 2004 · Q-19. A health plan which otherwise qualifies as an HDHP generally requires a 10 percent coinsurance payment after a covered individual satisfies the deductible. However, if an individual fails to get pre-certification for a specific provider, the plan requires a 20 percent coinsurance payment.

› filing › free-file-do-your-federalIRS Free File: Do your Taxes for Free - IRS tax forms Oct 17, 2022 · Each IRS Free File company will provide you information when you don’t qualify, with a link back to the IRS.gov Free File site. Seek help if you need it: If you need help when you are at a company’s IRS Free File site and doing your taxes, you may refer to the company’s free customer service options. IRS can help find a free option for you. Payment Vouchers | Arizona Department of Revenue - AZDOR 120/165V. Arizona Corporate or Partnership Income Tax Payment Voucher. Payment Vouchers. 141AZ V. Arizona Estate or Trust Income Tax Payment Voucher. Payment Vouchers. AZ-140V-SBI. Arizona Individual Income Tax Payment Voucher for Electronic Filing of Form 140-SBI. Payment Vouchers. Irs Coupons For Estimated Payments - bizimkonak.com Irs Estimated Tax Payment Form 2022 Coupon CODES (5 days ago) Free unlimited Irs Estimated Tax Payment Form 2022 Coupon with listing websites included hot deals, promo codes, discount codes, free shipping. IRS Payment Plan Installment Agreement Options - NerdWallet If you make your payments with a debit or credit card, you'll have to pay a processing fee. The charge for debit cards runs about $2 to $4 per payment; the charge for credit cards can be up...

Irs Tax Payment Coupons 2021 - bizimkonak.com Irs Coupons, Promo Codes & Deals - September 2022. 202225% off (9 days ago) 25% Off When You File Your IRS Form 2290 Tax For The Year 2018-19 With No Hidden Charges. Code. 20% Off IRS Form 2290. 1 use today. Code. 20% Off When You Pay Your … Visit URL. Category: coupon codes Show All Coupons

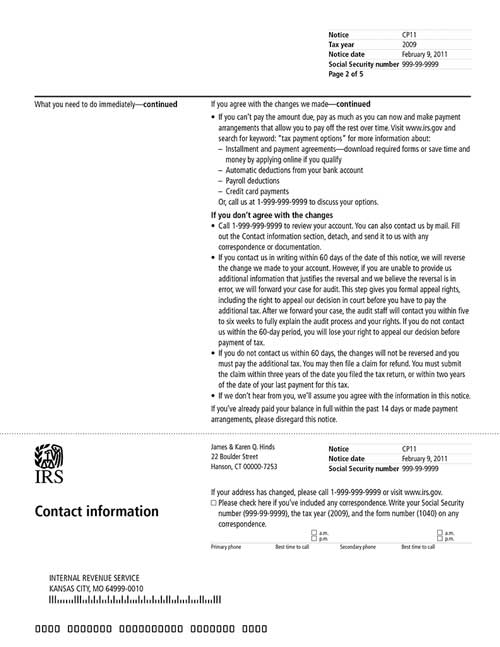

› newsroom › irs-operations-during-covidIRS Operations During COVID-19: Mission-critical functions ... Oct 13, 2022 · Taxpayers can ask for a payment plan with the IRS by filing Form 9465. Taxpayers can download this form from IRS.gov and mail it along with a tax return, bill or notice. Some taxpayers can use the online payment agreement application to set up a monthly payment agreement without having to speak to the IRS by phone.

turbotax.intuit.com › tax-tips › tax-paymentsWhat Is the Minimum Monthly Payment for an IRS Installment ... Oct 18, 2022 · Fees for IRS installment plans. If you can pay off your balance within 180 days, it won't cost you anything to set up an installment plan. If you cannot pay off your balance within 180 days, setting up a direct debit payment plan online will cost $31, or $107 if set up by phone, mail, or in-person using Form 9465.

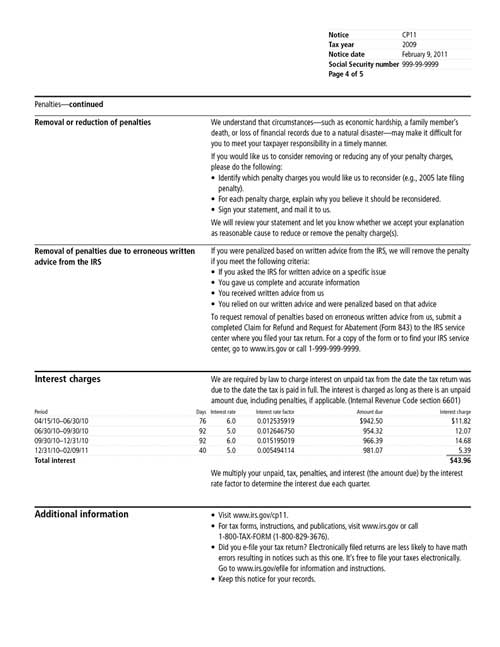

› penalties-for-lateLate-Filing and Payment Penalties for Federal Taxes - The Balance Mar 28, 2022 · The IRS Penalty for Late Payments . The late-payment or failure-to-pay penalty applies to any portion of your federal tax debt that remains outstanding as of the due date. The IRS imposes a failure-to-pay penalty of 0.5% for each month or part of a month that the tax goes unpaid, up to a total of 25% of the remaining amount due.

7 Ways To Send Payments to the IRS - The Balance You can typically take an extension by filing Form 4868 with the IRS (instead of a tax return) by the tax filing deadline, giving you until October 18, 2022, to submit your return. But any payment you owe is still due by the original tax due date, which is April 18 in 2022 for 2021 tax returns.

3 Ways to Set Up a Payment Plan with the IRS - wikiHow Businesses are eligible for long-term payment plans if they owe less than $25,000. If you owe more than $50,000 but less than $100,000, you are only eligible for a short-term payment plan. Generally, you must pay the full amount you owe to the IRS in less than 120 days. 2 Gather the information you'll need to apply online.

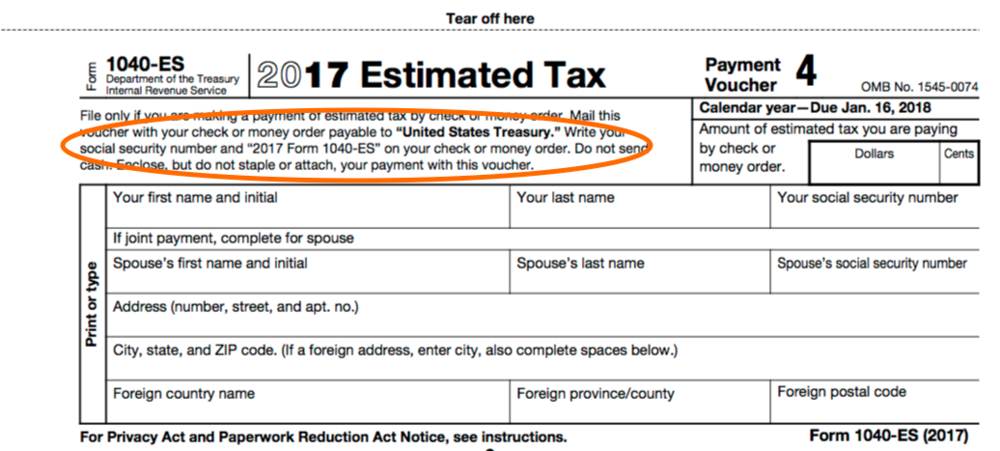

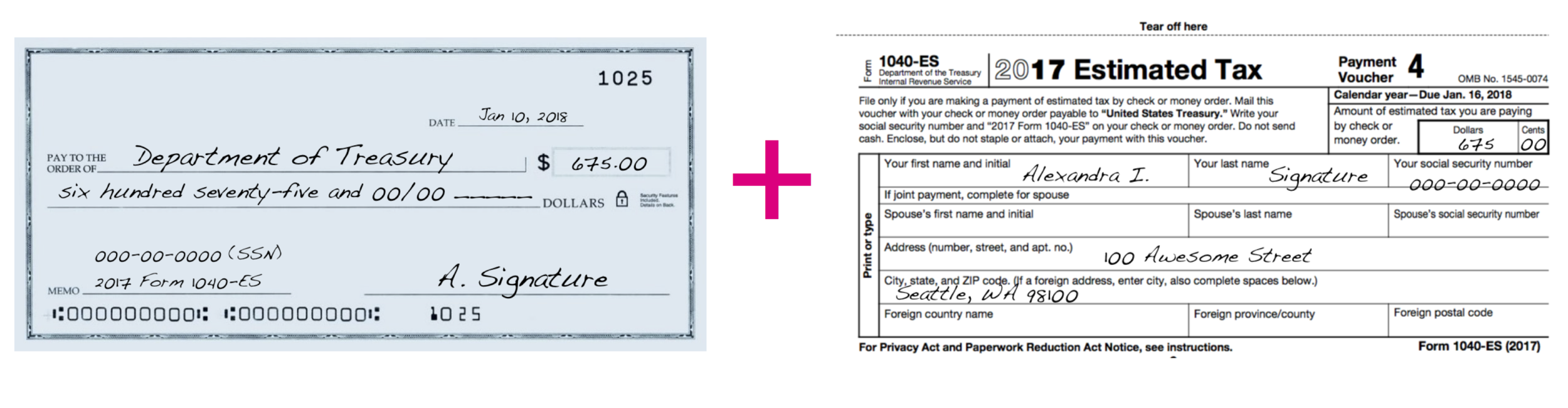

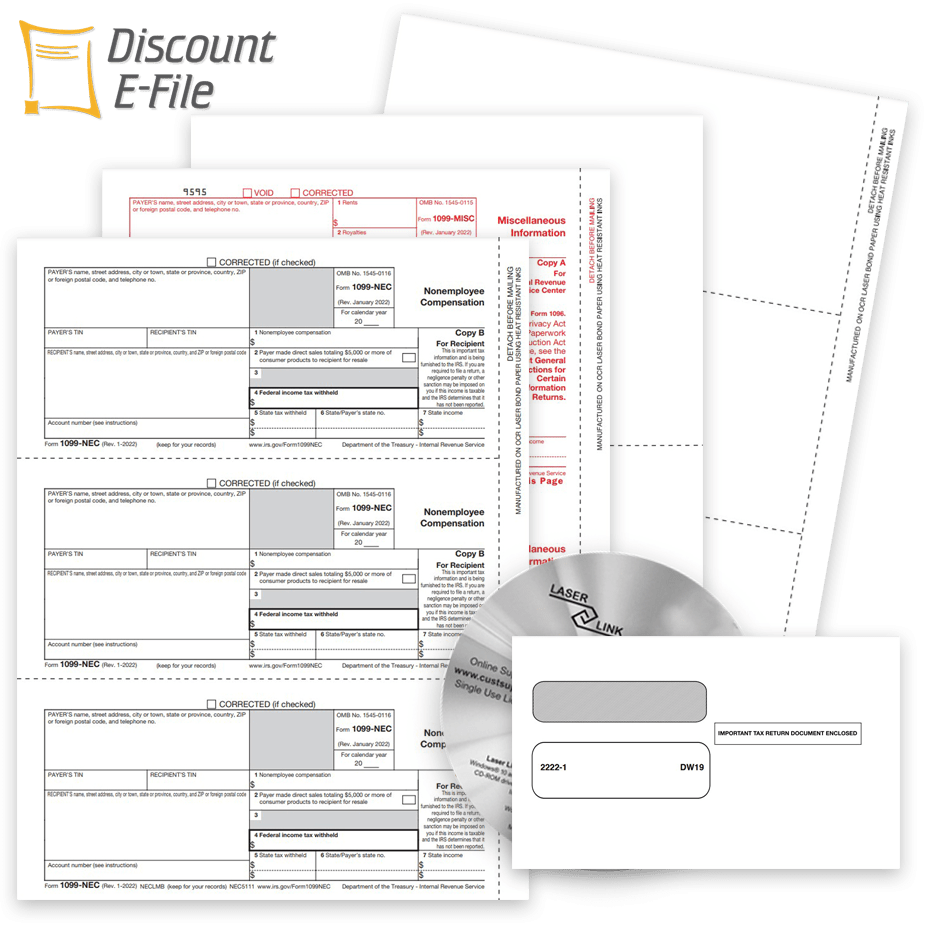

About Form 1040-V, Payment Voucher - IRS tax forms About Form 1040-V, Payment Voucher Form 1040-V is a statement you send with your check or money order for any balance due on the "Amount you owe" line of your Form 1040 or 1040-NR. Current Revision Form 1040-V PDF Recent Developments None at this time. Other Items You May Find Useful All Form 1040-V Revisions Paying Your Taxes

IRS Payment Options With a 1040-V Payment Voucher - The Balance If You Can Pay Within 120 Days. The process is similar if you can pay off the tax you owe within six months. Send in a partial payment using Form 1040-V, and then wait for the IRS to send you a letter telling you how much you owe, including interest and late charges. Next, call the IRS at the number shown on the letter.

Montana Withholding Tax Payment Voucher (Form MW-1) Montana Withholding Tax Payment Voucher (Form MW-1) - Montana Department of Revenue Montana Withholding Tax Payment Voucher (Form MW-1) December 30, 2021 You may use this form to make Montana withholding tax payments. You can pay your withholding tax liability with your paper voucher or by using our TransAction Portal (TAP) Download

IRS Direct Pay Redirect Step 1 of 5 Tax Information Select the appropriate payment type and reason for your payment. Information about payment types can be found by clicking the help icon ( ?). If you are making more than one type of payment or making payments for more than one tax year, submit each of them separately. Business Taxes?

Form 1040-V: Payment Voucher Definition - Investopedia Form 1040-V: Payment Voucher is a statement that taxpayers send to the Internal Revenue Service (IRS) along with their tax return if they choose to make a payment with a check or money order....

What is a Coupon Payment? - Definition | Meaning | Example What is the definition of coupon payment? Coupon payments are vital incentives to investors who are attracted to lower risk investments. These payments get their name from previous generations of bonds that had a physical, tear off coupon that investors had to physically hand in to the issuer as evidence that they owned the bond. It was also used as a way to track the steady payment stream to investors.

Home Equity Statement: Payment Coupon | Wells Fargo You can still use the coupon to mail in additional principal payments. If you are not enrolled in an automatic payment plan, call us at 1-866-820-9199 to enroll. Use the back side of the payment coupon to indicate any address, phone number, or email changes. Wells Fargo Home Mortgage is a division of Wells Fargo Bank, N.A.

IRS Phone Numbers: Customer Service, Human Help - NerdWallet The main IRS phone number is 800-829-1040, but this list of other IRS numbers could help you skip the line, spend less time on hold or contact a human faster. ... Ask you to pay your tax bill with ...

› publications › p550Publication 550 (2021), Investment Income and Expenses ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Garnishment Payment Coupon | NCDOR Employers that are served with a wage garnishment against their employee are to use and complete the Form NC-GARN Garnishment Payment Coupon to send along with the wages that are withheld from the employee's pay, in order for the funds to be applied correctly to the taxpayer's account. Files ncgarn.pdf PDF • 66.74 KB - September 25, 2018

Payment Coupon Templates - 11+ Free Printable PDF Documents Download Payment Coupon Templates - 11+ Free Printable PDF Documents Download. A payment coupon template was designed to help you help customers make payments at the counter in a personalized way. The coupon template is only used at an instance where you want your customers to purchase available items at discount prices.

Form 941-V Payment Voucher - Taxbandits You can only use payment voucher Form 941-V if your total taxes for the current or previous quarter are less than $2,500, you didn't incur a $100,000 next-day deposit obligations during the current tax quarter, and you're paying the amount you owe in full by the deadline.

2022 IL-501 Payment Coupon - Withholding (Payroll) Tax Forms - Illinois 2022 IL-501 Payment Coupon - Withholding (Payroll) Tax Forms Revenue Forms Withholding (Payroll) Tax Forms 2022 IL-501 Payment Coupon Did you know you can make this payment online? Paying online is quick and easy! Click here to pay your IL-501 online Click here to download the PDF payment coupon

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "43 payment coupon for irs"