44 yield to maturity of a coupon bond formula

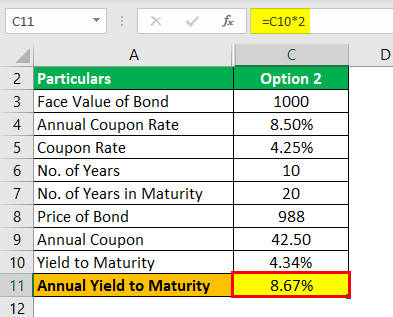

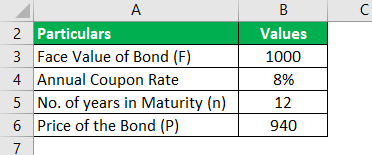

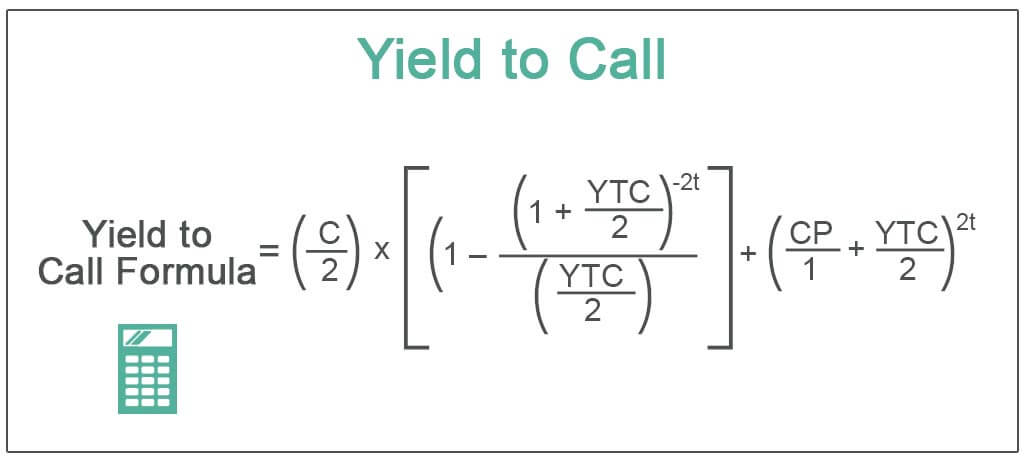

Yield to Maturity (YTM) - Definition, Formula, Calculation ... Yield to Maturity Formula = [C + (F-P)/n] / [ (F+P)/2] Where, C is the Coupon. F is the Face Value of the bond. P is the current market price. n will be the years to maturity. You are free to use this image on your website, templates, etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked For eg: Yield to Maturity (YTM) - Overview, Formula, and Importance Oct 26, 2022 · The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

Bond Yield Formula | Step by Step Calculation & Examples Bond Yield = Annual Coupon Payment/Bond Price =$78/$1600 Bond Yield will be – =0.04875 we have considered in percentages by multiplying with 100’s =0.048*100 Bond Yield =4.875% Here we have to say that increased bond prices result in decreased bond yield. Example #2

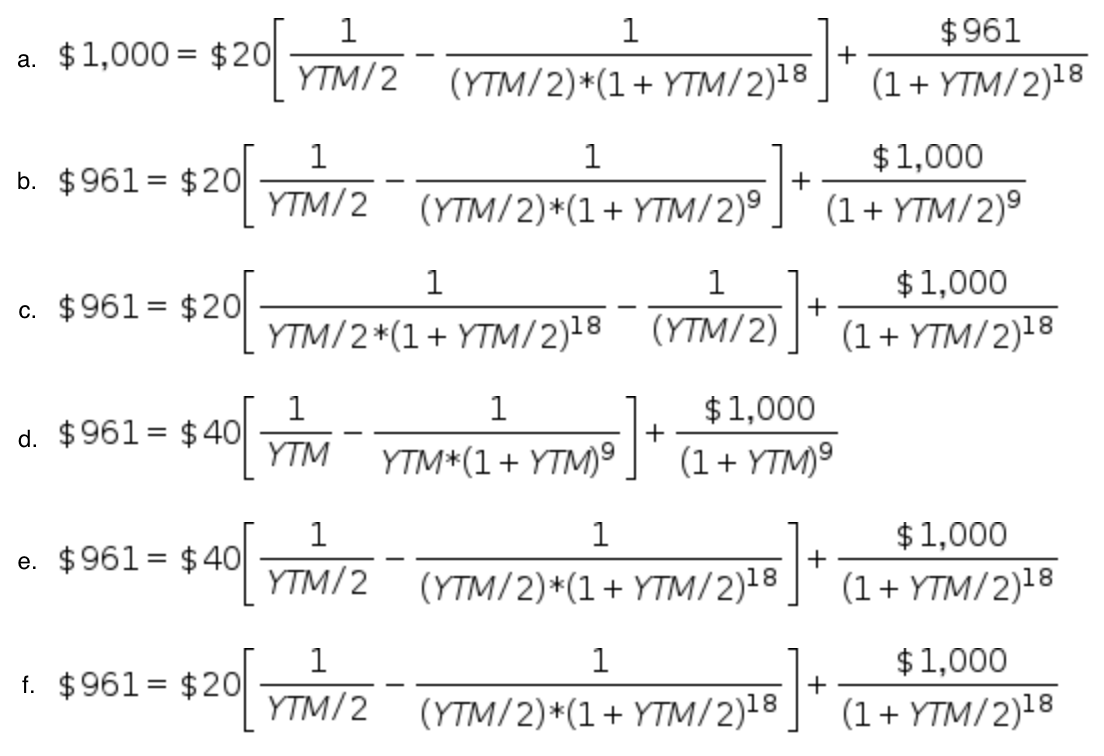

Yield to maturity of a coupon bond formula

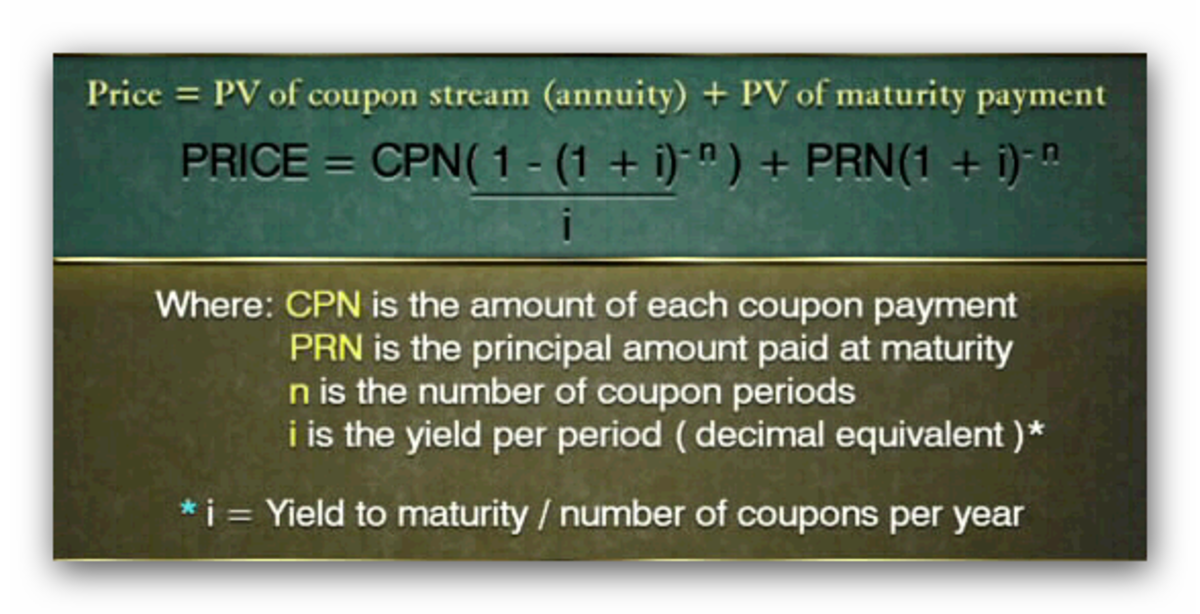

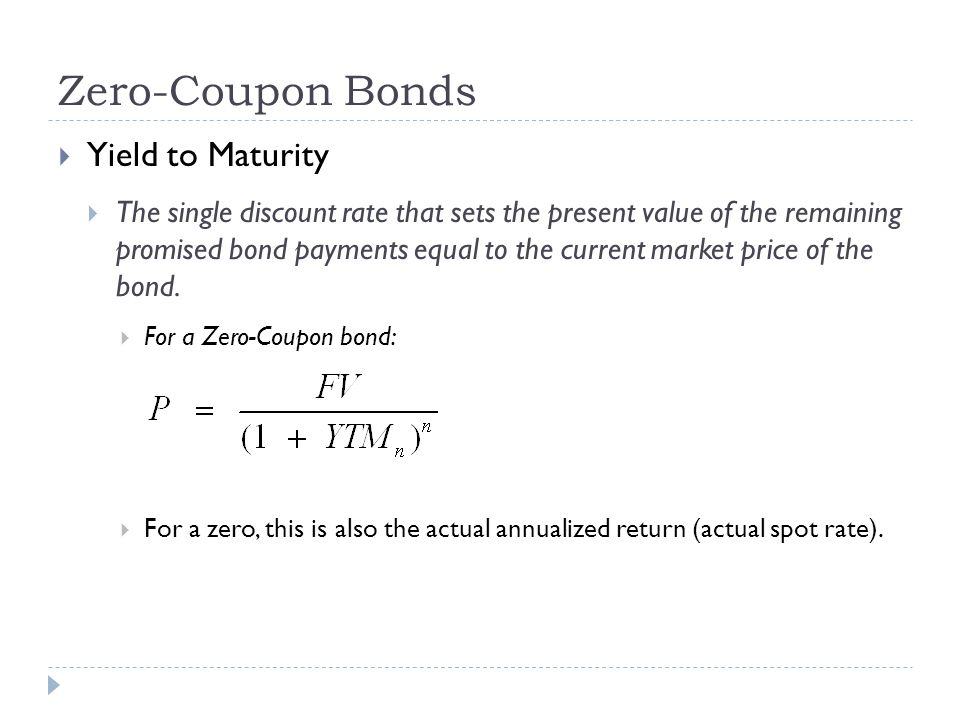

Yield to Maturity (YTM): What It Is, Why It Matters, Formula Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield but is expressed as an annual rate. In other words, it is the internal rate of return (IRR) of an investment in a bond if the investor holds the bond until maturity, with all payments made as scheduled and reinvested at the same rate. Yield to Maturity - Approximate Formula (with Calculator) Assume that the annual coupons are $100, which is a 10% coupon rate, and that there are 10 years remaining until maturity. This example using the approximate formula would be After solving this equation, the estimated yield to maturity is 11.25%. Example of YTM with PV of a Bond Using the prior example, the estimated yield to maturity is 11.25%. How To Calculate Yield To Maturity (With Example and Formula) Apr 08, 2022 · The bond matures in five years, with an annual coupon rate of five percent annually. Mark first calculates the semi-annual coupon rate by dividing the five percent rate by two, resulting in 2.5%.

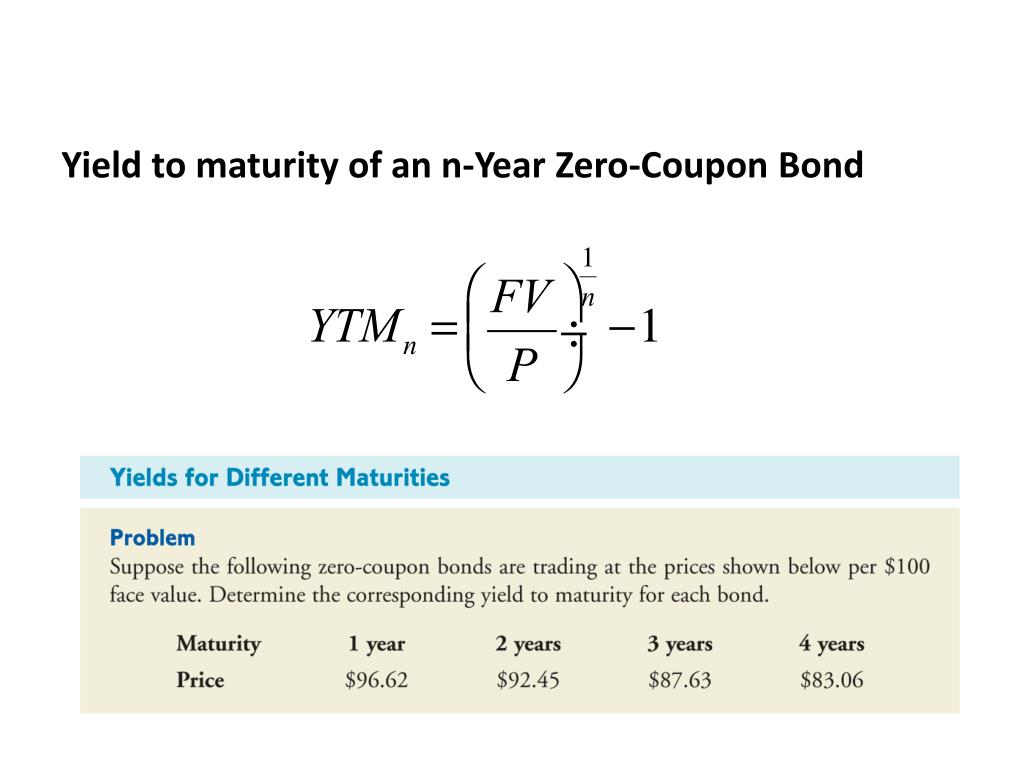

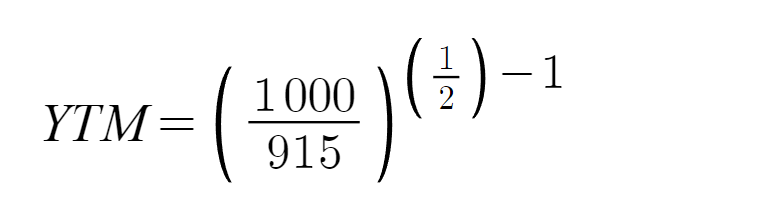

Yield to maturity of a coupon bond formula. How to Calculate Yield to Maturity of a Zero-Coupon Bond Yield to maturity (YTM) is an important metric used in bond markets that describes the total rate of return that is expected from a bond once it has made all of its future interest payments and repays the original principal amount. Zero-coupon bonds (z-bonds), however, do not have reoccurring interest payments, which distinguishes YTM calculations from bonds with a coupon rate . How To Calculate Yield To Maturity (With Example and Formula) Apr 08, 2022 · The bond matures in five years, with an annual coupon rate of five percent annually. Mark first calculates the semi-annual coupon rate by dividing the five percent rate by two, resulting in 2.5%. Yield to Maturity - Approximate Formula (with Calculator) Assume that the annual coupons are $100, which is a 10% coupon rate, and that there are 10 years remaining until maturity. This example using the approximate formula would be After solving this equation, the estimated yield to maturity is 11.25%. Example of YTM with PV of a Bond Using the prior example, the estimated yield to maturity is 11.25%. Yield to Maturity (YTM): What It Is, Why It Matters, Formula Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield but is expressed as an annual rate. In other words, it is the internal rate of return (IRR) of an investment in a bond if the investor holds the bond until maturity, with all payments made as scheduled and reinvested at the same rate.

Post a Comment for "44 yield to maturity of a coupon bond formula"