41 treasury bills coupon rate

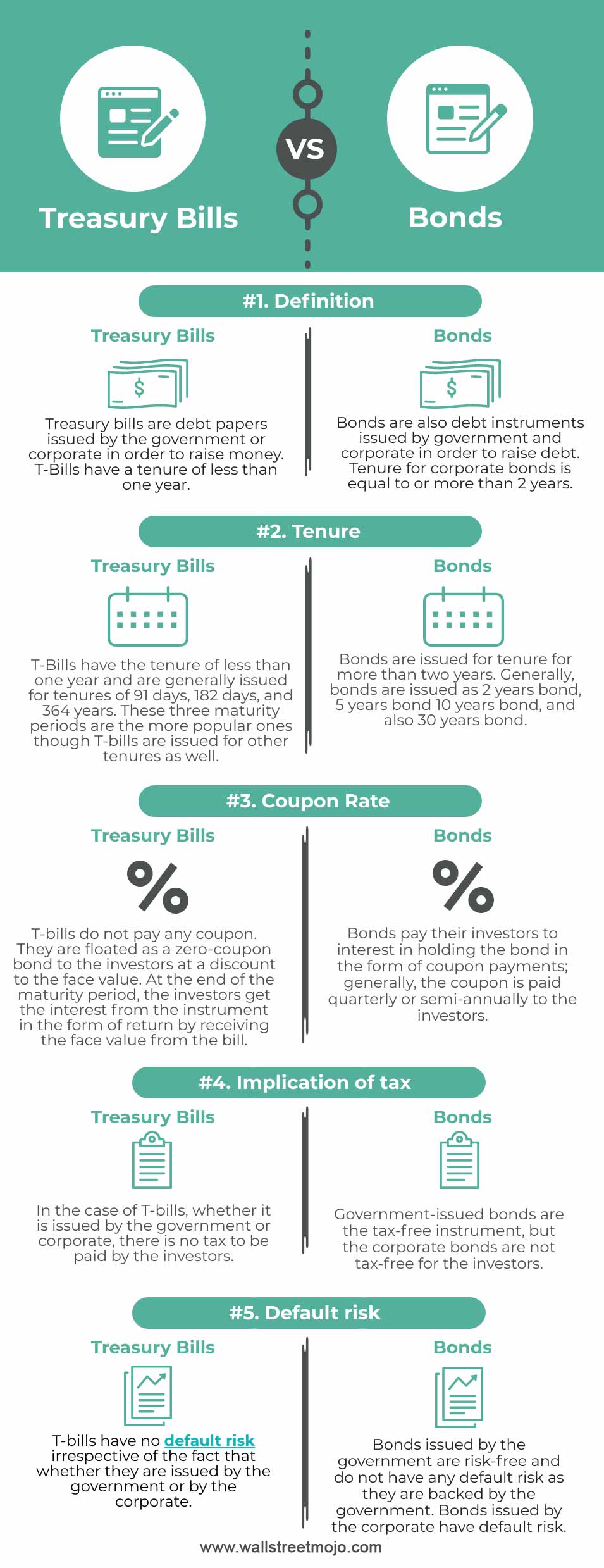

Treasury Bills Notes and Bonds: Definition, How to Buy - The Balance Treasury bills, notes, and bonds are fixed-income investments issued by the U.S. Department of the Treasury. They are the safest investments in the world since the U.S. government guarantees them. This low risk means they have the lowest interest rates of any fixed-income security. Treasury bills, notes, and bonds are also called "Treasurys" or ... Treasury's Certified Interest Rates — TreasuryDirect Treasury's Certified Interest Rates include Federal Credit Similar Maturity Rates, the Prompt Payment Rate, and Interest Rates for Various Statutory Purposes. Federal Credit Similar Maturity Rates Prompt Payment Rate Current Value of Funds Rate Interest Rates for Various Statutory Purposes

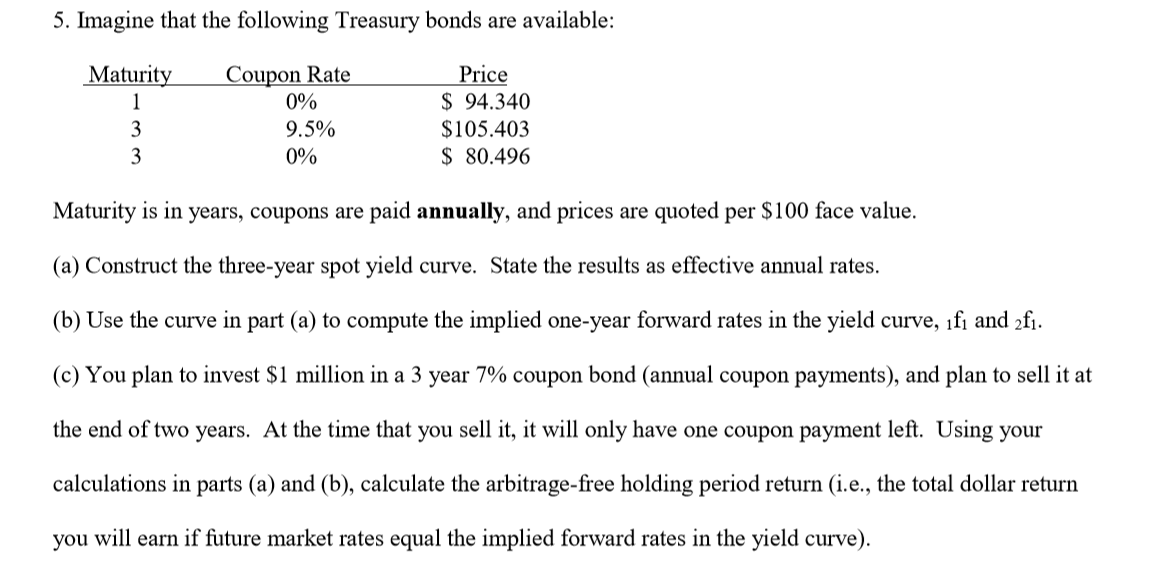

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

Treasury bills coupon rate

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price. Understanding Pricing and Interest Rates — TreasuryDirect To see what the purchase price will be for a particular discount rate, use the formula: Price = Face value (1 - (discount rate x time)/360) Example: A $1,000 26-week bill sells at auction for a discount rate of 0.145%. Price = 1000 (1 - (.00145 x 180)/360) = $999.27 The formula shows that the bill sells for $999.27, giving you a discount of $0.73. Do Treasury bills pay interest? - KnowledgeBurrow.com Do Treasury bills pay monthly? Every six months, treasury notes pay out an amount equal to half of their "coupon rate." Here's an example: say you have a $10,000 ten year treasury note with a coupon rate of 4.25%. They also have a coupon payment every six months and they also are valued at their face value upon maturity.

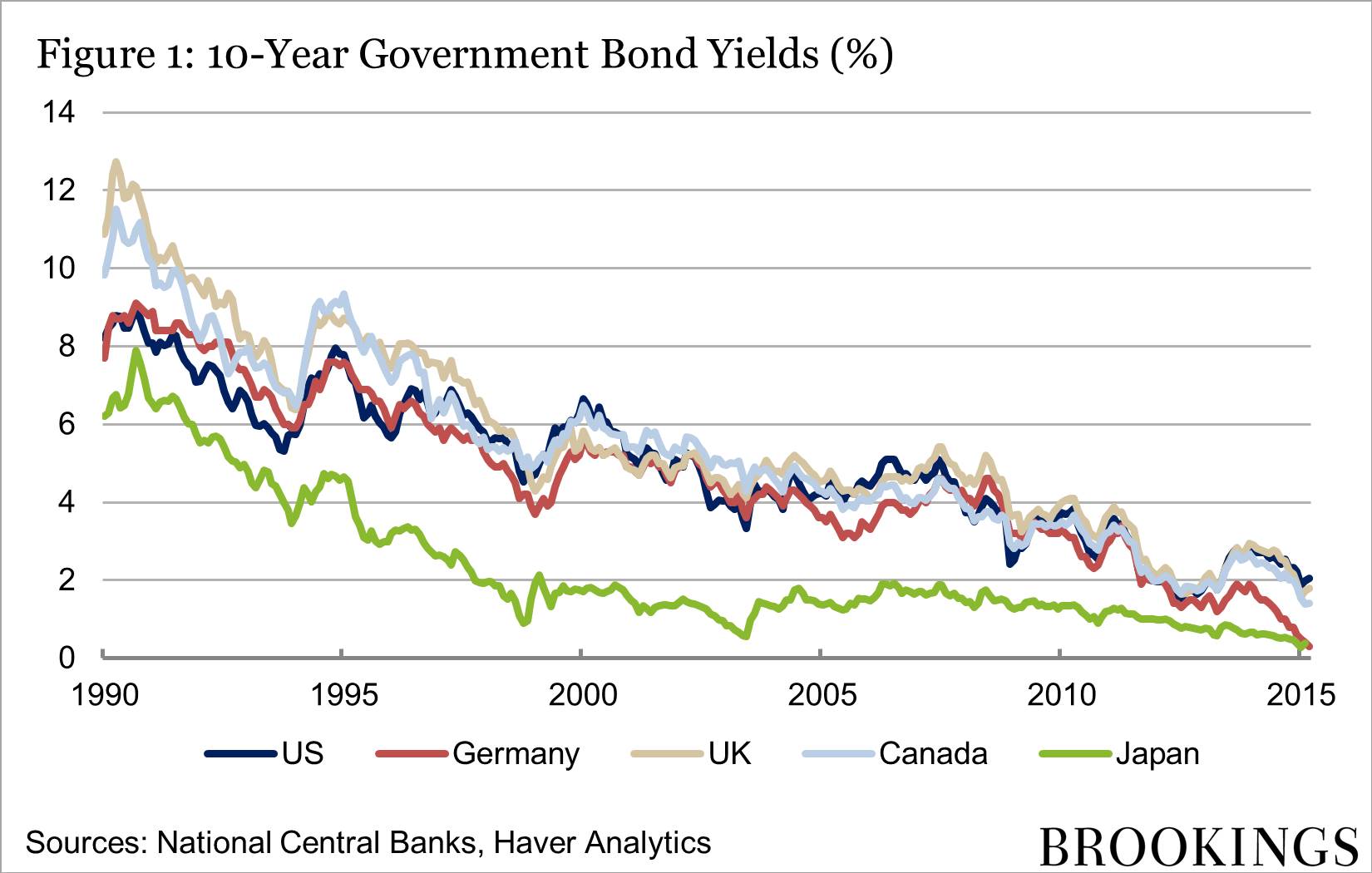

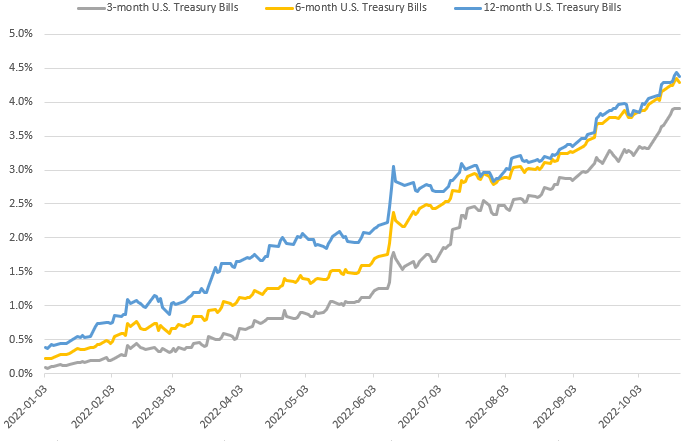

Treasury bills coupon rate. How Often do Treasury Bonds Pay Interest? | Fox Business A 30-year U.S. Treasury bond falls into that category. The most recently issued 30-year bond has a 2.75% coupon. The coupon rate determines the interest payments. The 2.75% is the annual coupon ... How To Invest in Treasury Bills - Investment Firms Treasury bills are sold at a discount rate, discounted from the face value of the security. For example, if the face value of a T-bill is $100,000 and is being sold at a discount rate of 1.5%; you would purchase the security for $98,500 and be paid $100,000 at the end of the bill's maturity. Treasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2013-2017 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2018-Present TNC Treasury Yield Curve Par Yields, Monthly Average: 1976-Present TNC Treasury Yield Curve Forward Rates, Monthly Average: 1976-Present TNC Treasury Yield Curve On-the-Run Par Yields, Monthly Average: 1986-Present How Often Does The Treasury Bill Rate Change? - Inflation Hedging Currently, Treasury bill rates are hovering around 2% even for the 1 year bill. This can be contrasted with two years ago when the rates were much higher, around 4%, and also very close to current rate levels for the 2-3 and 3-4 year treasuries. In fact, on average Treasury Bill rates have a yield of around 4.5%.

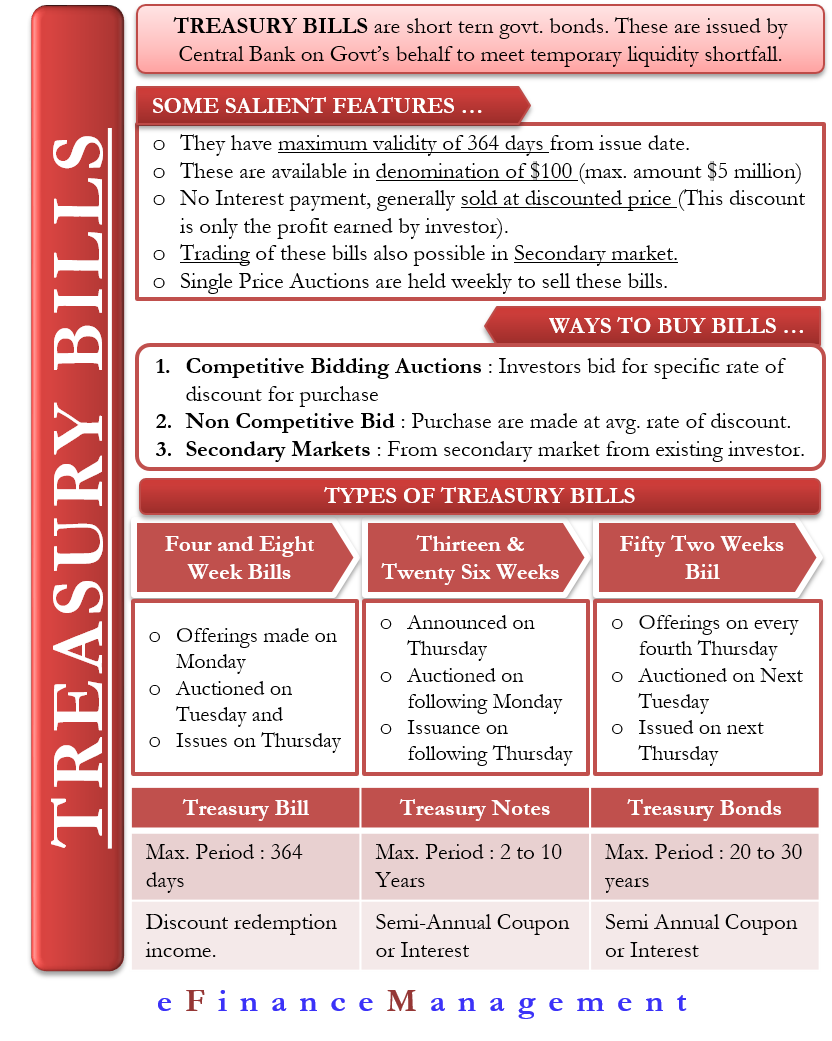

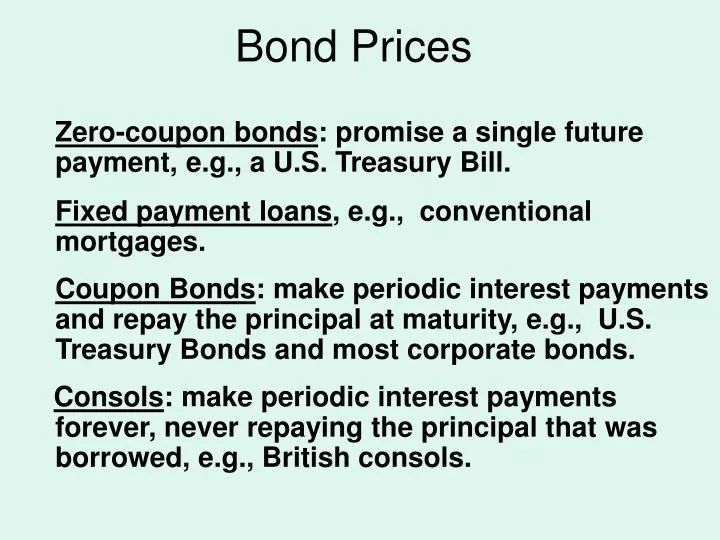

Treasury Bills - Guide to Understanding How T-Bills Work Treasury notes have a maturity period of two to ten years. They come in denominations of $1,000 and offer coupon payments every six months. The 10-year T-note is the most frequently quoted Treasury when assessing the performance of the bond market. It is also used to show the market's take on macroeconomic expectations. T-Bonds Important Differences Between Coupon and Yield to Maturity - The Balance Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon. For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. TMUBMUSD01Y | U.S. 1 Year Treasury Bill Overview | MarketWatch Treasury yields shoot higher, led by 1-year bill rate at 3.98%, as traders sell off bonds Oct. 5, 2022 at 9:43 a.m. ET by MarketWatch Why rising Treasury yields are plaguing the stock...

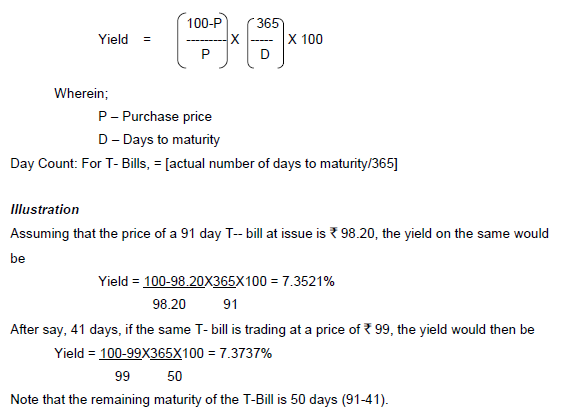

Treasury Bills | Constant Maturity Index Rate Yield Bonds Notes US 10 5 ... Bankrate.com displays the US treasury constant maturity rate index for 1 year, 5 year, and 10 year T bills, bonds and notes for consumers. How Are Treasury Bill Interest Rates Determined? - Investopedia For example, suppose an investor purchases a 52-week T-bill with a face value of $1,000. The investor paid $975 upfront. The discount spread is $25. After the investor receives the $1,000 at the... Treasury Bill Rates - Nasdaq Treasury Bill Rates. From the data product: US Treasury (12 datasets) Refreshed 2 days ago, on 5 Nov 2022 ... The Coupon Equivalent, also called the Bond Equivalent, or the Investment Yield, is the bill`s yield based on the purchase price, discount, and a 365- or 366-day year. The Coupon Equivalent can be used to compare the yield on a discount ... US T-Bill Calculator | Good Calculators For example, if you were to buy a T-Bill of $10,000 for $9,900 over a period of 13 weeks then you would have a profit of $100 and a rate of return of 1.01% US Treasury Bills Calculator Face Value of Treasury Bill, $: 1000.00 5000.00 10000.00 25000.00 50000.00 100000.00 1000000.00

Understanding Coupon Rate and Yield to Maturity of Bonds Let's see what happens to your bond when interest rates in the market move. When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the Coupon Rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and Coupon Rate is 2.375%.

Should You Buy Treasuries? - Forbes With interest rates rising, government bonds have become a lot more attractive for investors searching for a return on cash. The current rate on a U.S. two year Treasury is 3.05%.¹ In...

How does the U.S. Treasury decide what coupon rate to offer on Treasury ... Answer (1 of 3): The Treasury picks the coupon to the nearest 1/8th that prices the bond closest to par. E.g. if the implied 10yr Trsy yield is 2.03% when the auction happens, the Treasury would set the coupon as 2%. Simple as that. If the coupon were set to 6%, the bond would trade at a huge pr...

What Are Treasury Bills (T-Bills) and How Do They Work? - Investopedia As stated earlier, the Treasury Department auctions new T-bills throughout the year. On March 28, 2019, the Treasury issued a 52-week T-bill at a discounted price of $97.613778 to a $100...

Treasury Bills (T-Bills) - Meaning, Examples, Calculations - WallStreetMojo For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured.

Interest Rate On Treasury Bills - InterestProTalk.com Latest stop rates from the Nigerian Treasury Bill auction held last week revealed some of the lowest rates for the nations T- Bills market in recent times. The 91-day bills had stop rates of 1% and the 182-day bills was also 1%. For the full year, the 364-day bills had an equally low rate of 2%.

United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EST) GTII5:GOV . 5 Year

How To Invest In Treasury Bills - Forbes Advisor Treasury Bills. T-bills have short maturities of four, eight, 13, 26 and 52 weeks. Since they offer such short maturities, T-Bills don't offer interest payment coupons.

6 Month Treasury Bill Rate - YCharts The 6 month treasury yield reached nearly 16% in 1981, as the Fed was raising its benchmark rates in an effort to curb inflation. 6 Month Treasury Bill Rate is at 4.44%, compared to 4.45% the previous market day and 0.07% last year. This is lower than the long term average of 4.48%. Stats Related Indicators Treasury Yield Curve

Treasury Bills Statistics - Monetary Authority of Singapore SGS T-bill Yield Curve. 6 12 Tenor (Months) 2.870 2.875 2.880 2.885 2.890 Yield (%) Latest Yield. Previous Week.

What are coupons in treasury bills/bonds? - Quora Treasury bills do not have a coupon rate; they are sold at a discount and redeemed at face value, also known as par value. Treasury bonds and bills have a coupon rate. The coupon rate is the interest rate on the par value of the bond that the bondholder receives annually.

Do Treasury bills pay interest? - KnowledgeBurrow.com Do Treasury bills pay monthly? Every six months, treasury notes pay out an amount equal to half of their "coupon rate." Here's an example: say you have a $10,000 ten year treasury note with a coupon rate of 4.25%. They also have a coupon payment every six months and they also are valued at their face value upon maturity.

Understanding Pricing and Interest Rates — TreasuryDirect To see what the purchase price will be for a particular discount rate, use the formula: Price = Face value (1 - (discount rate x time)/360) Example: A $1,000 26-week bill sells at auction for a discount rate of 0.145%. Price = 1000 (1 - (.00145 x 180)/360) = $999.27 The formula shows that the bill sells for $999.27, giving you a discount of $0.73.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

:max_bytes(150000):strip_icc()/-1000-denomination-us-savings-bonds-172745598-cdf4a528ed824cc58b81f0531660e9c9.jpg)

:max_bytes(150000):strip_icc()/shutterstock_164681615-5bfc2b55c9e77c0026305abc.jpg)

Post a Comment for "41 treasury bills coupon rate"